General aspects

Chile is located between the Andes to the east, the Pacific Ocean to the west, the Atacama desert to the north and the great glaciers to the south. It is a South American country with a surface of 756,102.4 km2, a population of 17.4 million inhabitants and a GDP per capita of USD 14,413.

Its geographic characteristics provide this country with unique isolation conditions in the Latin American region, and this has been a great advantage for the eradication of diseases with an enormous economic importance in the pig industry, such as PRRS and Classical Swine Fever (CSF).

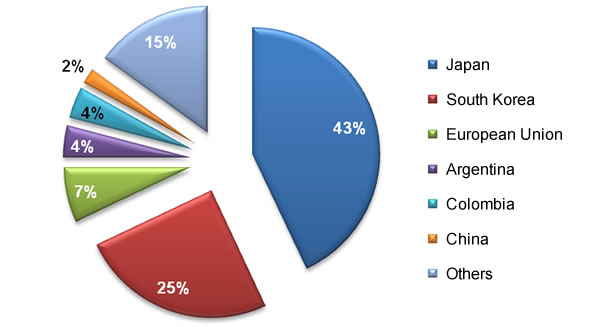

The Chilean pig industry mantains an expansive production process in which each of its companies have increased their productivity during the last two decades. In the past, the pig production was made up by companies that carried out their activities in an independent and isolated way. At present, these companies are organized and associated, and this allows a high planning for the achievement of commercial goals. Its market goal is to increase the domestic consumption of pig meat (25.7 kg/inhabitant) and, especially, satisfy the demands of international markets with high requirements levels, amongst them Japan, South Korea and the European Union (see Graph 1). The Chilean pig sector produces products with a higher added value, and it places more importance on the quality than on the volume. At present it holds the sixth place amongst the exporting countries, due to a production and commercial strategy. The annual pig meat production is 500,000 tons, approximately, and the amount assigned to exportations reaches a 40%. At the end of year 2009, a report by the National Statistics Institute recorded a total of 97 companies in the pig sector, and it also mentioned that the pig meat production had an increase of a 96.5% in the last 10 years. With respect to importations, in year 2009 they reached 5,300 tons: this amount is very stable and it does not undergo changes higher that a 1% per year. This meat comes from Canada and USA mainly.

Graph 1. Chilean pig meat exportations during year 2011 (211,000 tons approx.)

(Source: ODEPA Chile)

Production and costs

Chile has, mainly, a production system in multiple sites. Nevertheless, there are still producers that have monosite or farrow-to-finish systems. At present there are approximately 250,000 sows in technified swine farms, in which each of the sows weans a mean of 27 piglets per year, whilst the TOP-10 producers obtain 28.7 weaned piglets per sow per year. During the last few years, the numbers of piglets born alive has undergone great increases, and the mean reaches 12.64 piglets born alive per sow. The TOP-10 producers reach 13.48 piglets born alive per sow. The performance in site 2 (growing or weaner pigs stage) and in site 3 (fattening stage) can be seen in Table 1.

Table 1. Production parameters in the Chilean pig industry.

| Production data 2011 | TOP 10 | Mean | |

| Breeding | |||

| Replacements | % | 53.28 | 54.8 |

| Farowing rate | % | 91.87 | 91.08 |

| Farrowings/Sow/Year | number | 2.41 | 2.38 |

| Mean number of piglets born alive | number | 13.48 | 12.64 |

| Mortality in the farrowing quarters | % | 11.18 | 9.86 |

| Age at weaning | days | 20 | 22 |

| Weight at weaning | kg | 6 | 6.3 |

| Weaned piglets/sow/year | number | 28.7 | 27.07 |

| Site 2/Growing stage/Weaner pigs stage | |||

| Mortality + Discarded animals | % | 1.14 | 1.26 |

| Daily weight gain | kg/day | 0.375 | 0.414 |

| Conversion rate | kg/day | 1.5 | 1.56 |

| Age at exit | days | 68 | 72 |

| Weight at exit | kg | 24 | 27 |

| Site 3/Fattening stage | |||

| Mortality + Discarded animals | % | 2.86 | 2.06 |

| Daily weight gain | kg/day | 0.917 | 0.893 |

| Conversion rate | kg | 2.68 | 2.84 |

| Age at exit | days | 176 | 175 |

| Weight at exit | kg | 123 | 119 |

| Kilograms per sow/year | kg | 3,392 | 3,115 |

(Source: PIC Andina).

The main cost in the Chilean pig industry is that of compound feed: it reaches a 73.8% of the total production costs. After it we have labour, with an 8% of the total production costs (see Table 2). One of the weak points of the Chilean pig industry is that it depends heavily on the importations of cereals and oilseeds: a ton of maize delivered at the compound feed processing plant costs USD 308 per ton, whilst soya costs about USD 460 per ton. These prices make that all the producers focus all their efforts and invesments in order to attain a high efficiency with respect to the use of the compound feeds and attain, in this way, a profitable and economically sustainable production system.

Table 2. Production costs in the Chilean pig industry

| Production costs (USD/kg) | ||

| Weaned piglet cost | USD | 25.59 |

| Total cost/kg sold | USD | 1,5 |

| Compound feed cost | % | 73.8 |

| Labour cost | % | 8 |

| Animal health cost | % | 3.2 |

| Genetic cost | % | 2 |

| Energy cost, heating | % | 4.2 |

| Marketing cost | % | 0.9 |

| Other costs | % | 7.9 |

| Raw materials costs | ||

| Maize (delivered at the compound feed processing plant) | USD/ton | 308 |

| Sorghum (delivered at the compound feed processing plant) | USD/ton | 279 |

| Soya (delivered at the compound feed processing plant) | USD/ton | 460 |

| Cost of the compound feed (diets) | ||

| Stage 1 | USD/ton | 1,069 |

| Stage 2 | USD/ton | 819 |

| Stage 3 | USD/ton | 565 |

| Stage 4 | USD/ton | 439 |

| Development 1 | USD/ton | 401 |

| Development 2 | USD/ton | 382 |

| Fattening 1 | USD/ton | 354 |

| Final fattening | USD/ton | 325 |

| Pregnancy | USD/ton | 302 |

| Nursing | USD/ton | 430 |

(Source: PIC Andina).

Animal health

Chile has a high health status, and this is due, mainly, to its natural barriers and to an efficient joint work between the private and the public sector, and this has given, as a result, the eradication of diseases as, for instance, PRRS and Classical Swine Fever. Likewise, this professional group, made up by the veterinarians from the swine companies and the Agriculture Ministry (via the Servicio Agrícola Ganadero, SAG = Agricultural and Livestock Service), are in charge of carrying out an active control and monitoring in order to prevent the entry of exotic diseases that affect swine and livestock production in general.

The animal health programs are focused on a high healt status strategy in which the biosafety in the farm, the early weaning at 21 days and the all-in-all-out system are carried out in a very active and conscious way.

The normal vaccination programs in a pig farm are based on the control of the diseases caused by the swine circovirus, Micoplasma hyopneumoniae, the swine parvovirus, swine erisipelas, and Escherichia coli.

Future prospects

According to estimations, during the next 5 years the Chilean pig sector will keep growing, with increases in production that will exceed a 50% and exportations that will reach a 60% of its total production. One of the great leaps shown by the Chilean pig industry was that, since year 2011 it started to export pig meat to China, a strategic commercial partner that has a great buying potential.