The spread of African Swine Fever in China – and more recently to Belgium (close to France and Germany) – has substantially altered the outlook for the pork industry around the world. Prospects for improved export demand have grown following recent events, while the potential for the disease to spread globally has grown exponentially.

The spread of African Swine Fever in China – and more recently to Belgium (close to France and Germany) – has substantially altered the outlook for the pork industry around the world. Prospects for improved export demand have grown following recent events, while the potential for the disease to spread globally has grown exponentially.

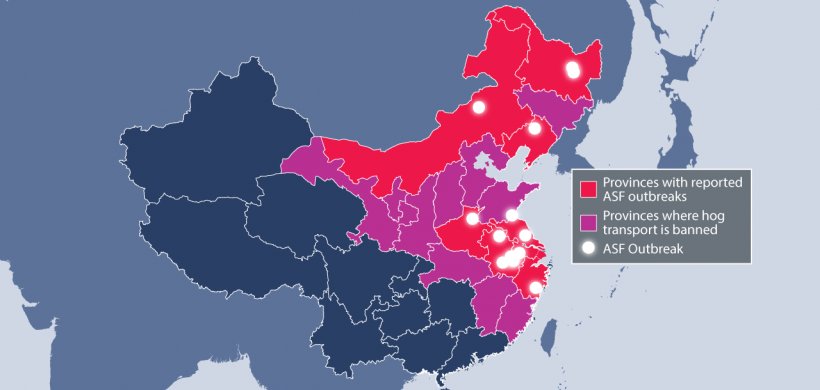

The spread of ASF in China has been rapid and serious

As of 18 September 2018, China has reported 20 cases of African Swine Fever (ASF) in seven provinces (see Figure 1). Based on the broad dispersion of cases reported to date, it is unlikely that this disease has been contained, and additional cases are expected to be reported. To contain the spread of the virus, China has restricted the movement of live animals within the seven provinces with ASF cases, as well as the eleven neighboring provinces.

While the long-term repercussions are unclear, what we know today is that the curb on transport of animals within China has created significant dislocations in animal and/or pork supplies. Surplus pork is weighing on markets as producers rush to market healthy stock. At the same time, prices in urban centres, along with regions in eastern and southern China, without readily available production have seen as much as a 40% increase in prices since transport bans were implemented. If we use the herd losses we saw in the 2007 outbreak of PRRS (AKA blue ear disease) as a benchmark, it is possible to extrapolate that a supply gap of as much as 2m to 3m tonnes could emerge in the coming months.

A new outbreak in Europe could prove just as serious

The 13 September discovery of ASF-positive feral pig carcasses in southern Belgium is a cause for serious concern. Feral pig populations in the region are dense – and if the disease is now in the population, it will be difficult to contain its spread. We expect European officials to implement strict biosecurity measures in response, but if feral pigs carry ASF into export-heavy countries like France or Germany, global trade could be significantly impacted. Any disruption in exports from top European trade partners would leave Asia with few options.

No pork production region remains unaffected

For North American producers and processors, this outlook offers reasons to be both concerned and optimistic. For US hog producers, along with those in Canada and Brazil, we expect the disruption in key pork-production regions to open export opportunities. Initially, this will likely be ‘panic buying’ by customers worried about the availability and cost of future pork supplies. By early 2019, we expect markets to have a better understanding of the outbreak and resulting import needs. Much depends on western European countries – that currently supply about 35% of global pork exports – to remain ASF-free. If the virus spreads in Europe via the feral pig population, we believe there could be significant export demand for US, Canadian, and Brazilian pork, as well as sizable demand for competing proteins (beef, chicken, and seafood).

The potential spread of the disease throughout Asia and/or Europe also poses a great risk to North American and South American producers. Efforts to find and close all potential methods of contamination are underway. For example, in the US, the industry is working with animal health and trade officials to ensure potential points of entry are secure. Feed supplies, casings, and imports of contaminated meat are all being heavily scrutinised.

So what happens next?

We believe import-dependent nations will build stocks where possible and begin establishing ASF-free suppliers. This may work to the benefit of North American and South American pork exporters, as well as global poultry and beef suppliers. We believe China and affected parts of Europe will work to isolate and eliminate the source(s) of contamination. Nevertheless, efforts to rebuild secure supplies are likely to take months. In the meantime, Chinese consumers are likely to shift away from more expensive, scarce supplies of pork and toward alternative proteins like chicken, farmed whitefish, and even beef. In unaffected production zones, we expect stepped-up biosecurity and testing to ensure continued access to export markets. While there is still much we do not know about how ASF will spread in the coming months, what is clear is that the scale of potential upside in demand and potential risk of contamination has perhaps never been greater.

September 2018 - Rabobank