Key trends in 2019

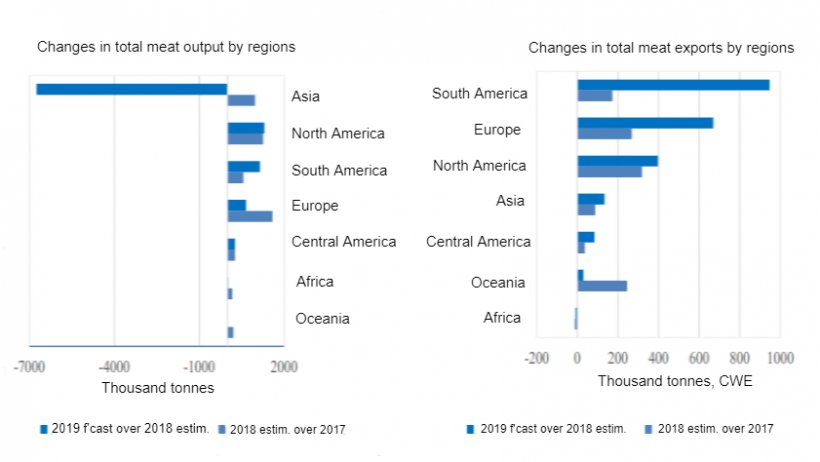

Global meat output is forecast at 335 million tonnes (in carcass weight equivalent) in 2019, 1.0 percent lower than in 2018. This marks a departure from the stable growth trend recorded over the past two decades, principally due to the impact of African Swine Fever (ASF) in China and its spread to several East Asian countries. China’s meat output is forecast to fall by 8 percent. The overall decline in China’s meat output reflects a contraction of pig meat output by at least 20 percent, partially offset by higher production of other meats. Production gains are expected in pig meat production, reflecting robust demand from China. Argentina’s meat production is likely to rise, primarily on increased culling.

World meat exports are forecast at 36 million tonnes in 2019, up 6.7 percent from 2018, principally driven by increased imports by China due to domestic tightness caused by ASF-related production losses. China’s overall meat imports are expected to rise by 35 percent (around 2 million tonnes). By contrast, several countries are expected to import less meat, including the United States of America and Angola. On the export side, much of the anticipated expansion in global demand is forecast to be met by Brazil, the European Union, the United States of America, Argentina, Thailand and Canada.

The FAO Meat Price Index registered moderate month-on-month increases since the start of 2019, with pig meat, frozen in particular, recording the sharpest rise due to the surge in import demand by China.

Pig meat

World pig meat output is forecast to fall to 110.5 million tonnes in 2019, down 8.5 percent from 2018 due to the spread of the ASF. In China, pig meat output is forecast to fall by at least 20 percent, equivalent to almost 11 million tonnes, in 2019. While this caused domestic pig meat prices to rise sharply, it provided incentives for producers to rebuild herds. The ASF spread seriously affected pig inventories in Viet Nam too, leading to the slaughter of more than 5.9 million pigs, roughly one-fifth of the country’s total pig population. As in other countries, higher pig meat prices led consumers to switch to other meat products. Short-term rebound in pig stock numbers is unlikely, given the extent of the disease spread and the domination of small-scale farms. Other Asian countries, including the Republic of Korea and the Philippines, also reported ASF outbreaks in recent months, thus limiting the production loss this year.

Largely driven by strong Asian demand, pig meat output is predicted to increase in the Americas, mainly in the United States of America and Brazil. Expansions are also expected in Europe, mostly in the Russian Federation and to a lesser extent in the European Union. Despite retaliatory tariffs, vigorous demand from China encouraged the United States of America to boost production, which is forecast to increase by 4.8 percent to 12.5 million tonnes. At the same time, in Brazil, output is anticipated to expand by around 5.5 percent, reflecting increased producer margins due to higher pig meat prices, sustained by active import demand and lower feed costs. The Russian Federation is forecast to step up production by around 3 percent, underpinned by largescale investment in the pig meat sector. Meanwhile, the European Union is anticipated to see its output increase only modestly.

World pig meat exports are forecast to expand by 12.2 percent to 9.3 million tonnes in 2019, almost totally fueled by an increase in imports by China, which is predicted to absorb 90 percent of additional exports. The Asian country has increased its imports by 29 percent year-on year through September. Among others, Japan is set to expand purchases, albeit marginally, as domestic production is likely to increase.

Strong international demand and relatively tighter supplies contributed for the European Union pig meat export prices to register over 30 percent increase from January to October this year.

Brazil’s exports are also expected to register an increase this year, especially due to buoyant import demand from China. At the same time, hindered by a temporary import ban by China that existed between June and early November this year, Canada diversified pig meat shipments to other markets, notably to Central America, mainly Mexico along with Cuba and Panama, partially offsetting reductions elsewhere. Exports to Canada have increased since Canada removed retaliatory tariffs in May 2019 in response to the removal of tariffs on steel and aluminium by the United States of America. Among others, Chile is anticipated to record a 20 percent increase in exports in 2019, because of a surge in Chinese demand.

December 2019/ FAO.

http://www.fao.org/