EU production expected to stabilise

The EU breeding herd is back to a decreasing trend in 2018 ( -3% year-on-year), after the expansion in 2017. There were significant herd reductions in PL (-18%), NL (- 9%), DE (- 4%) and RO (- 9%), due to low prices, African Swine Fever (ASF) risk and/or environmental restrictions. By contrast, Spain pursues the expansion of production, driven by growing extra-EU exports: the breeding herd grew by 2 % and production by 5% in this Member State. Nevertheless, EU production is expected to remain stable in 2019 thanks to productivity gains and expected growth in export demand Depending on the level of the rise of China demand due to the spread of ASF, EU production could be boosted into positive growth.

EU prices should rise in 2019, after low prices in 2018

Significant EU production growth in 2018 (+2%) led to pigmeat prices below the last 5 - year average. Slightly higher feed prices added pressure on producer margins. 2019 started with similar price conditions, however prices are rising as supply tightens and export prospects improve, particularly towards China. Apparent consumption per capita rose by 0.5 kg in 2018 (32.6 kg) supported by high availabilities. It should readjust in 2019 as the market balances, down to 32.2 kg.

EU pigmeat exports expected to grow in 2019

EU pigmeat exports grew by 4% in 2018, but fell to the main destination China (- 8 %) and to Hong Kong (- 43%). In 2019, pigmeat exports should grow significantly (+9%) as Chinese demand rises. EU offal exports fell by 6% in 2018, driven by falling demand from Hong Kong (-38%). Overall volume of meat&offal exports grew by 1% but fell in value by 7% in 2018.

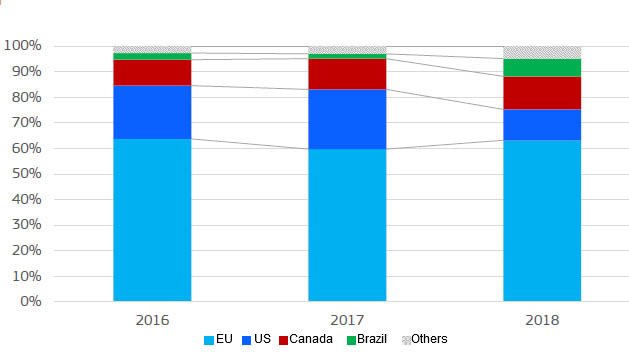

EU kept its share of Chinese market in 2018

Chinese import demand, the main driver of world pork trade, fell by 13% in 2018; the EU maintained its share above 60%. The closure of Russian market in 2018 pushed Brazilian exports to the Chinese market, where they rapidly increased their share. Meanwhile, the share of the US halved due to the trade frictions; it should recover if China ends its retaliatory tariffs. Growth of world trade in 2019 will depend on the level of Chinese demand.

Wednesday April 17, 2019/ DG Agriculture/ European Union.