Unlike 2018, the year 2019 was marked by a strong increase in margins for pig farms. The increase in the price paid benefited most pork-producing countries. Production costs remained stable on average (-0.4%) although by country there were variations of between -8 and +9% between 2018 and 2019.

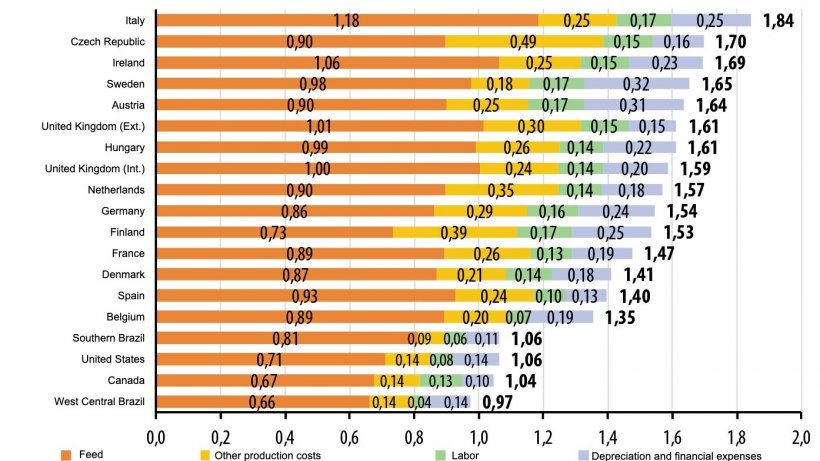

The InterPIG group calculates the different production costs for pig production in 19 countries or regions (UK data is split between outdoor (Ext) and indoor (Int) pigs and all costs are expressed in euros for comparison purposes). In 2019, the difference in costs was almost double between west central Brazil and Italy, reflecting the diversity of situations. Italy is developing differentiated products by producing heavier and better-valued pigs, in contrast with countries on the other side of the Atlantic where the cost of production is lower and pigs are cheaper.

Cost breakdown in 2019 (€/kg carcass). (Source: Ifip from Interpig data).

This difference in production costs can be explained by the price of the production factors and by the technical performance of the farms. The feeding cost varied between 0.66 €/kg carcass in central Brazil and 1.18 €/kg carcass in Italy. Feed is the most significant expense item, representing at least 48% of the production cost in Finland and up to 76% in southern Brazil. The weight of the other items depends on the cost of the facilities, the cost and productivity of the labor, and various operating costs (replacement of animals, health expenses, water and energy, etc.). The variability of the labor cost is explained by the significant differences between countries in terms of the cost of labor per hour (from 3.2 €/hour to 26.3 €/hour). Variations in the price of new construction are also significant, from 2,087 €/sow in Brazil to 12,113 €/sow in Finland. These variations explain the differences within the item "depreciation and financial expenses". Canada, Spain, the United States and Brazil continue to be the most competitive in this regard. Denmark and the Netherlands have the highest labor costs, but compensate for this with their high labor productivity. Denmark, which specializes in farrowing, continues to lead in terms of sow productivity with 33.6 weaned pigs per productive sow per year. It is followed by the Czech Republic and the Netherlands (30.9 and 30.1 weaned pigs/sow). France is in fifth place (29.4 weaned pigs/sow), with an increase of + 6% in the trend since 2015, behind Germany.

Price received by producers is rising in most countries, driven by increased demand from Asia. Brazil, Denmark, Spain, and the United States are benefiting the most, with differences between received price paid to producers and production cost exceeding 0.20 €/ kg carcass. Among the six countries with negative results are countries with little presence in the export market, but also Canada, hit by export barriers to China between June and November 2019.

Undoubtedly, the results from pig farms will be lower in 2020. The COVID-19 crisis is disrupting the slaughterhouse industry in Europe, and pork markets causing a fall in prices. The presence of ASF in Germany adds to the many uncertainties already looming over the market.

Lisa Le Clerc, lisa.leclerc@ifip.asso.fr