In a couple of previous posts early this summer I was suggesting that the record profitability of hogs in the United States would cause US producers to fight the summer weight declines more vigorously than they normally do. Even when there are little or no profits, if you can prevent or slow weight decline in the summer through very carefully administered management tactics, it means extra profits, so not just this year but every year, this same incentive exists.

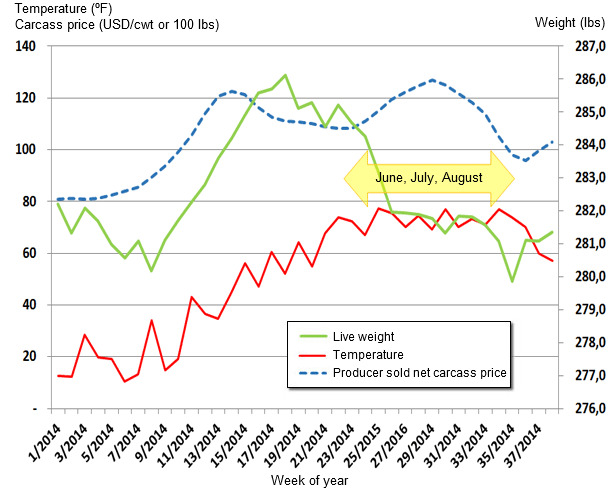

Figure 1. Update on US weekly average live weight, carcass price and temperature changes.

Source: USDA AMS market news service and University of Dayton.

Figure 1 completes our view of US producer’s performance for the year as the summer season has now drifted into fall. We can see the typical pattern for average weights play itself out in Figure 1. To my surprise, like every other year, the magnitude of the weight decline has been almost exactly equal to the average of previous years. That average decline for the summer period is about 6-8 lb (2.7-3.6 kg) and stretches from May through August. One thing that is interesting about this is that regardless of the peak weight in late spring of any year, the decline in weight is roughly the same in absolute terms. This year it was a smaller percentage loss because average weights were so high to start with, though total decline matched the average year.

The weekly average live weight in the US this year fell from a peak of 286.1 lb, (130.0kg) to the summer low of 279.9 (127.2 kg). The peak weight was achieved in the perfect growing temperatures of late spring (May) and the summer low weight happened during a kill-shortened national holiday week in early September (the US Labor Day weekend, which is always a three day weekend and marks the “unofficial” end to summer). You can observe the big jump in prices for the summer (the blue dashed line) when the largest drop in summer weights occurs from week 24-26. This was early in June when summer temperatures had reached their annual average high and had plateaued.

So I can conclude that even massive profitability cannot stop the average US live hog weight from falling 6-8 lb (2.7-3.6 kg) over the summer months. The average weight decline for this period in the year since 2001 has been 8 lb (3.6 kg), from a fourteen year average high live weight of 269 lb (122.2 kg) to an average bottom at 261 lb (118.6 kg) just ahead of the fall increases. Nevertheless, individual producers do manage to hold weight and when they do, they enjoy additional windfall summer profits.

The quarterly USDA Hogs and Pigs report was just released and indicates there will be big trouble ahead for US hog producer profitability (probably in late 2015), unless another random shock hits the system. This also assumes that the impact of the PEDv virus begins to burn itself out through a stronger immunity and perhaps better farm and biosecurity practices.

The USDA report, which is a compilation of an extensive survey of US pork producers each quarter, surprised the regular set of trade people who make public guesses about what the survey will show in advance of its release. The trade consensus missed just about every category in the report by being too pessimistic on inventory levels and farrowing intentions. The report indicates that the breeding herd in the US is up 2.0% as of September 1 compared to one year ago. And while the production pipeline is still way down due to PEDv deaths, it is not as far down as trade personnel estimated. This suggests expansion has become more vigorous than many people think.

From the survey, producers indicated the intention to farrow over 4% more sows during September-November 2014 compared to a year ago and 3% more during the period December 2014- February 2015 (also compared to a year ago). Couple that with very low feed ingredient prices coming on with the 2014 harvest and you have all you need for fire to break out: oxygen (PEDv becoming manageable), fuel (high profits and lower feed ingredient prices ahead) and a spark (intentions to farrow 3-4 percent more sows than the same period 2013)!

Of course, there are lots of things that could dramatically slow intended expansion so we will be watching closely. However, it is hard to imagine a period of historical profitability not leading to a vigorous expansion of the breeding herd and of course, the resulting disappearance of profits altogether.