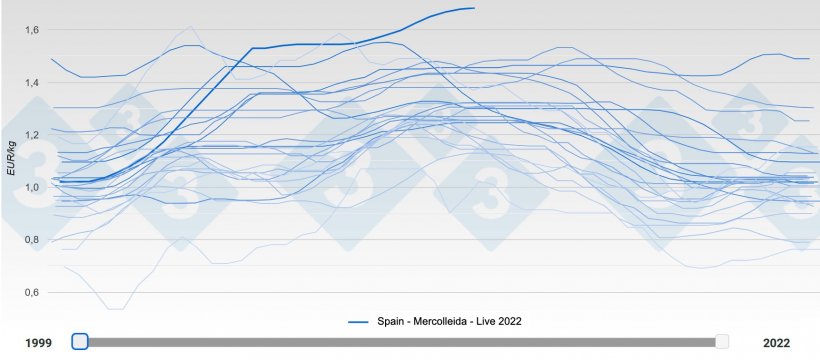

In July Spain witnessed weekly markets with hard-fought and agonizing rises to reach the upper price limit of the year for the moment (in absolute terms and without deflations all records have been broken). Never before had pigs in Spain reached a price of 1.689 €/kg live.

Never before had pigs in Spain reached a price of 1.689 €/kg live.

A heat wave has been raging in Spain since the beginning of June (we are already in the third heat wave of the summer) and the pigs are suffering- they are not eating and they are not growing. Fires are raging all over southern Europe and there is still a lot of the summer left. The average carcass weight slaughtered in Spain is now practically three kilos below last year's weight at the same time. We believe that weekly slaughterings in Spain this July have been at least 20% lower than in January and February. There are no pigs and those that do exist are not reaching the desired weight.

The pork market has not reacted; in spite of the shortage of slaughterings throughout the EU there is pork left over for everyone, so its price has not risen. This apathy in the pork market has prevented the price of pigs from rising further, despite insufficient supply.

We believe that in August the price of pork in Spain will at most stay the same. What happens will depend on the rest of the EU markets. For weeks now, the two large German slaughterhouses (Tonnies and Vion) have been paying 10 cents below the reference pig price. This circumstance could (and almost should) be a prelude to a generalized price drop, but the German offer is so short that it is not clear what will happen in the end. One thing is certain, however, and that is that the slaughtering capacity in Germany is currently oversized.

Spanish slaughterhouses are running at very negative margins, causing them significant losses week after week. At the same time, the processing industry is also losing, since its sales prices have not been able to reflect a large part of the radical increases in pork prices in March. And pig producers complain that so far this year their accounts are also negative. It seems impossible for the three key links of pig production to be in trouble at the same time, but this is the current reality.

In the United States, carcasses are worth the equivalent of €2.78/kg while in November 2021 they were worth only €1.08/kg. They have risen 135% in just six months. There they are slaughtering far less than normal and their domestic market is strong: their pork is expensive and their exports have declined. Their lack of exports leaves gaps in international markets that Spanish slaughterhouses take advantage of without hesitation.

In the People's Republic of China, we note that the price of piglets has been at a high or very high level for months (this is usually a foretaste of price increases for slaughter pigs). The live pig price there is skyrocketing. From April to today, the price has risen from the equivalent of €1.78/kg live to €3.33 live, an increase of 87% in just three months. This leads us to believe that before the end of the year China will recover -at least in part- its leading role in importing significant quantities of pork. This does not seem to be a utopia to us.

The conflict in Ukraine remains paralyzed with no sign of a solution. Inevitably, we live in uncertainty and insecurity. Although the price of grain has flexed downwards (some speculative investment funds have abandoned positions for fear of an announced recession), food remains expensive. Energy costs are soaring, with no signs of being contained in the short or medium term. The fragility of long supply chains is a constant, both in terms of inputs and sales. It is almost impossible to navigate in the midst of doubt, confusion, and indecision. And yet there is only one option left: to move forward no matter what the cost. Resilience becomes essential.

In August prices in Spain will stay the same or may even start to decline. For September/October the Spanish price scenario will depend on the international framework. If China and other markets are active in their purchases, the Spanish pig price will fall little, slowly, and in a measured way; if this "external aid" does not exist, we fear that there will be an abundance of pigs and that the decreases will cascade one after the other. Nothing is written in stone and everything remains to be seen. As in the past, we will be attentive to reality in order to understand and explain it.

In our previous article, we announced our intention to comment on what European pig production will look like in 2023. So far all the major operators we have contacted have refused to let us publicize their views. We are still in the thick of it and in one form or another we will break down (or try to) what is to come.

To conclude, we will mention an enthralling quote from Descartes, one of the most brilliant exponents of reasoning: "Whether I am asleep or awake, two plus three will always be five and the square will have four sides". We are talking about mathematical certainties, absolute truths: the kind of certainties that are so difficult to find in pig farming.

The future is full of challenges.