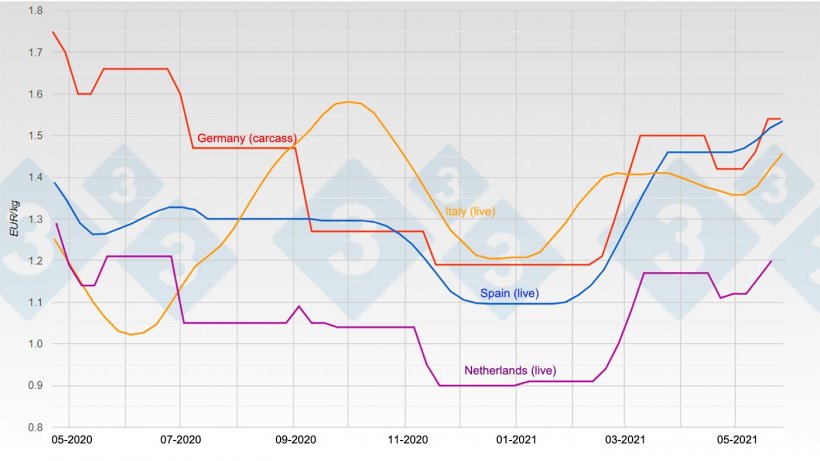

Since the emergence of ASF in Germany, reference prices in both markets -Spanish and German- have followed radically different trajectories. At present, the reference price in Spain looks more like a Monument to the Pig Price than a real market price.

In fact, the pig price in Spain is by far the most expensive in the EU as a whole, including Italy (where the price tends to be considerably more expensive; Italy is not an important pork export market). From all Member States, if you want to look at the Spanish price you have to raise your head and look up - exactly what you do when you want to admire a monument.

During the month of May we have seen the following results in the Spanish reference market: + 1 cent; + 2 cents; + 2.80 cents, and finally + 1.70 cents. In Germany in the same weeks: prices stayed the same, + 4 cents in carcass, + 8 cents in carcass, and finally prices stayed the same in the short week due to the Pentecost Monday holiday.

At this moment the official price in Spain is around 1.53 €/kg live farm gate. In Germany also at this moment, the price would be equivalent to 1.19 €/kg live farm gate. The coldness of these figures tells us that there is a long way to go in Germany, while here in Spain we are very close to the upper limit.

The recovery of the pig herd in China has led to a decrease in their needs and, therefore, a decrease in their imports: both in quantity and price. Chinese buyers seem to have set out to buy at a cheaper price and there is no doubt that they are succeeding. In a crude but defining approximation of what is happening we would say... "China is absent".

In the last four weeks there have been agonizing market sessions in Mercolleida: pig farmers - noting that the demand for live animals far exceeds what they have available - are ready to go up without regard, and slaughterhouses - noting that pork prices are going down or at best staying the same - are ready to go all out to minimize increases.

In the absence of China, Spanish slaughterhouses have looked for alternatives everywhere, the most obvious being destinations within the EU, the less obvious in countries as far away as Australia.

The pig price is going up market session after market session but with pork prices going down or staying the same, the slaughterhouse margin has not only eroded at full speed but has entered into very tangible losses. To get around this situation, the only solution would be for pig prices to go down, and for them to go down, there must be plenty of pigs left over. No pigs is left over, on the contrary, the farmer is pampered with care, lest he change customers...

For the time being the live market in Spain is still unbridled. And traditionally in the summer there will be even fewer pigs available. It is not foreseeable that prices will go down in June. On March 19 we wrote in this section: "It is not unreasonable today to think that in June the Spanish price will reach 1.55 or 1.58."

It so happens that without China (its purchases are now only a faint shadow of what they were in the first quarter), Spain has lost the differential fact that had allowed it to sustain a truly luxurious price in the confines of the EU. Without China we cannot have a price of 1.53 if our competitors are at 1.20 (Germany), 1.17 (the Netherlands) or 1.36 (France). Either they go up or we go down. We believe that in the short term the trend will be that the prices stay the same (or that there will be minor increases) in Spain with more important rises in Central Europe.

Graph 1. Evolution of pig prices in Germany, Spain, the Netherlands, and Italy.

It is very likely that the improvement in the weather will bring with it an increase in consumption in old Europe. These consumption increases are very necessary to avoid pork surpluses. Mass slaughterings of sows in Germany, the Netherlands, and Belgium will also help to raise pig prices there.

Everything is different and exceptional this year. The average annual price so far in Spain has been about 25 euro cents per live kilo higher than in Germany and about 10 euro cents higher than in France. Some farmers (not Spanish farmers) suffer the unspeakable and others (Spanish farmers) swim in abundance. Let us remember that 25 cents per live kilo is equivalent to 25 euros per head. A real fortune.

It seems to us that the price in Spain is very close to the upper limit; that it will remain at these levels at least until the beginning of July and then, if China does not return, anything can happen. It also seems to us that the summer of 2021 will be long remembered by slaughterhouses because of their negative economic results.

From a bird's eye view it is obvious that Spanish farmers should not worry; looking at their European competitors it is easy to see that they are all worse off. From the raging present to the recent past. And the future is unwritten.

Let's end with a reflection from Napoleon Hill on his thoughts about personal development: "The starting point of all achievement is desire".

Guillem Burset