EU pigmeat production growth will slow down in 2021

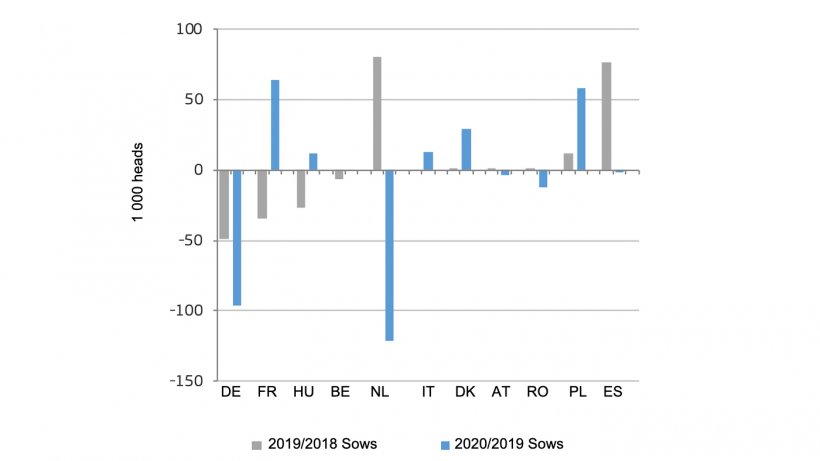

EU pigmeat production increased by 1.2% in 2020, driven by the export demand. The December 2020 livestock survey indicates an increase in the number of fattening pigs by 750 000 heads or 0.8%. The number of piglets also increased by 2.2 million heads, mainly in France. This will probably lead to an increase of pigmeat production in the first half of 2021. The number of sows, on the contrary, decreased by 0.5%.

After a stabilisation during summer 2020, pig prices started to decline again mainly due to COVID-19 restrictions in slaughterhouses. This was accelerated at the end of 2020 by the discovery of ASF in wild boars in Germany mid-September and the resulting export bans. This put a downward pressure on prices until the beginning of 2021, when they started recovering notably thanks to continuous demand from China and lower domestic supply.

Overall, the production of pigmeat is set to increase only slightly by 0.7% in 2021. The apparent consumption of pigmeat is projected to increase to 32.7 kg per capita (+1.4%) as more pigmeat will be available on the domestic market.

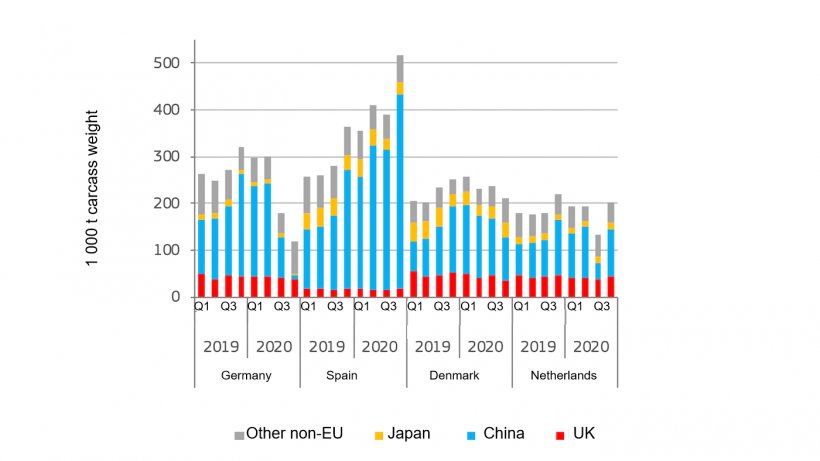

Exports to China at record level despite ASF

Exports of pigmeat were up by 18% in 2020. By far the largest share went to China, increasing its trade with the EU by around 1 million t. Although the ASF cases in Germany resulted in immediate trade restrictions of exports to key partners (China, South Korea and Japan), other EU member states were able to take over the gap left by German traders. Other EU countries, like Belgium, Hungary and Poland, are (still) facing similar export restrictions.

After two years of spectacular growth, exports will decrease but still stay at very high level. The pigmeat sector in China starts to recover but new cases of ASF are still appearing, which may slow down progress. The recovery from ASF in other Asian regions will take even more time. Despite the search for a vaccine against ASF, no successful trials or developments have been reported.

March 30, 2021/ European Commission/ European Union.

https://ec.europa.eu/