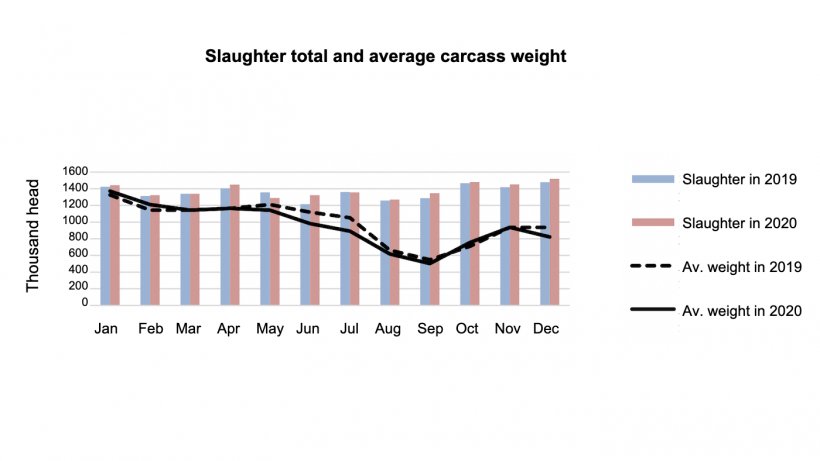

Japan’s 2021 beginning swine herd is estimated at 9.100 million head, nearly flat from 2020. Strong pork demand in 2020 led operators to slaughter hogs at a faster pace, yielding slightly lower carcass weights. Operators capitalized on the strong market to increase sow stocks which are forecasted to expand 2% to 860,000 head. Increased sow retention combined with expanded imports of live breeding swine pushed piglet production up 1% in 2020 to 16.945 million head and is expected to support an additional 1% expansion in 2021 to 17.050 million head.

In 2020, about 0.3% of the swine population had to be culled due to outbreaks of classical swine fever. To compensate, Japan ramped up imports of live breeding swine which increased four-fold in 2020 to 2,521 head, mostly from Denmark.

2021 slaughter is projected to increase at a slightly slower pace, to 16.610 million head, as demand pressures relax and allow for more normal rates of slaughter and carcass weights. Official government data recorded 2020 slaughter at 16.596 million head yielding 1.298 million MT in pork production.

Projected 2021 pork consumption is revised slightly downward to 2.725 million MT, nearly

flat from 2020. Overall 2020 consumption is revised lower to 2.724 million due to weak foodservice demand during the pandemic. These trends are expected to persist into early

2021.

Pork imports to remain slow in 2021

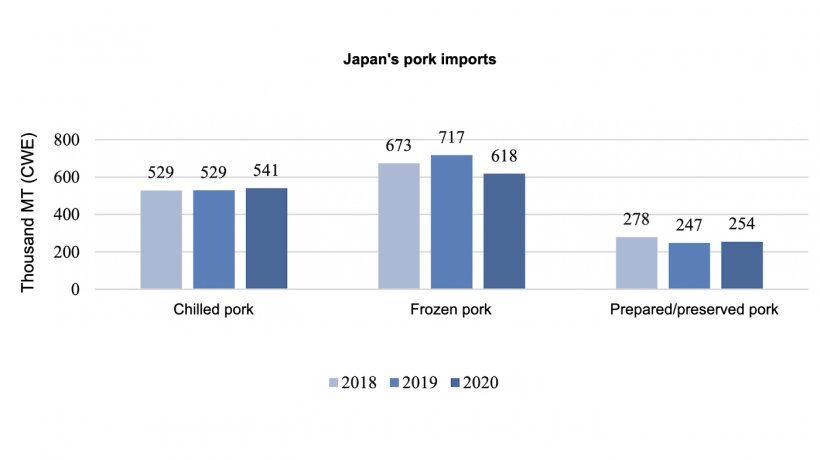

Strong domestic production combined with sluggish consumption will limit 2021 imports to just 1.420 million MT. This follows a steep decline in 2020 which saw pork imports fall 5% to 1.412 million MT. With foodservice sales expected to remain weak in the first half of 2021, imports will remain slow, growing just half a percent compared to 2020.

Japan’s imports of chilled pork, which is primarily diverted to retail, grew 2% in 2020 while imports of prepared/preserved pork grew 3%. However, this was not enough to offset a decline in frozen pork imports which fell 14%.

Imports from the European Union, the leading supplier of frozen pork, were especially hard hit, falling 24% year-on-year. As a result, the United States emerged as the leading pork supplier to Japan in 2020. Imports of U.S. pork rose 10%, driven mainly by growth in chilled pork and ground-seasoned pork (GSP).

March 9, 2021/ USDA/ United States.

https://apps.fas.usda.gov/