The pig market situation deteriorated sharply last week with the entry into force of several confinement orders and curfews and the increasingly fierce competition from German pork on the intra-Community market. This has resulted in a fall in prices after a long period of stability or a series of moderate falls. The German reference price is the only one that remained the same, but tension is mounting as slaughter postponements increase week by week with some 570,000 pigs waiting to be slaughtered. In October, slaughter was down 10% compared to last year and no short-term solution is in sight. Companies regularly undergo time-consuming tests and quarantined personnel are not replaced. To make matters worse, Blömer's processing plant has suspended production for probably two weeks due to cases of COVID-19 among its employees. The fear now hanging over the German market is that these delays will accumulate as the end of the year approaches along with the traditional decrease in activity that could generate a backlog of 1 million animals for slaughter. In addition, uncertainty about the duration of restrictions (restaurant closures, etc.) has considerably reduced the processing companies' order books. Unable to export to Asia, Germany is flooding the European market with pig products at ultra-competitive prices: hams and pancetta destined for Italy have fallen by 10 cents a kilo; prices for loins are especially falling.

In Belgium, the reference price has fallen by 3 cents per kilogram live, while slaughterhouses have been applying their own prices for a few weeks. The difficulties in exporting live pigs to Germany and the current impossibility of exporting to Asia are throwing the industry into chaos. Supply is under pressure, weights are rising to record levels, and the meat market is also under stiff competition.

The Danish price fell by 6 cents. According to ISN, Denmark also faces a slowdown in activity due to health protection measures in slaughterhouses. The supply of pigs is increasing as fewer piglets are exported to Germany. On the other hand, as a precaution, Danish Crown has closed two of its plants that export to China. The price in Austria dropped by 9 cents. The previous week's holiday postponed slaughter. In addition, the closure of restaurants complicates sales and increases the supply of meats, which also compete strongly with German meats.

In Spain, the price per kilogram live fell by 2.5 cents, so the decline is also accelerating there. It is true that the Spanish market also has to face very aggressive competition from German meat on its fresh market, leading to price cuts on certain pieces (-5 cents on ham). On the other hand, the supply is increasing and weights are still rising despite record slaughter activity.

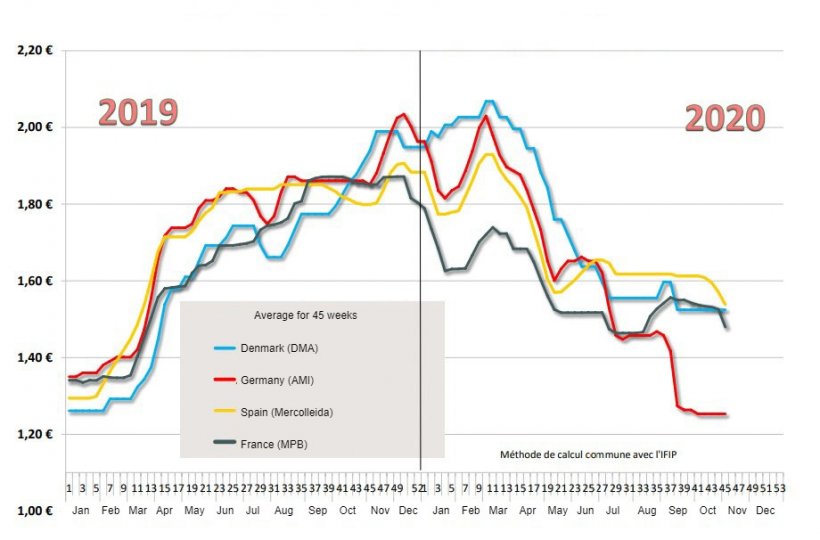

In Italy, there is a new decrease close to the maximum in a market that is deteriorating week after week. There is supply of half carcasses from Northern Europe at unbeatable prices and they are finding buyers in markets that were not interested before. The measures implemented to combat the COVID-19 pandemic are halting activity in the processing sector as there is a lot of uncertainty regarding orders generally linked to the Christmas and New Year festivities. Estimation of the average price paid to pig producers.

The fall in prices in the United States is confirmed, although they remain around 20% above the same references in 2019 and 2018. Slaughters in week 44 were 2.683 billion head, stable with respect to the previous week and very close to the slaughters for the same week in 2019. The resurgence of the pandemic is affecting activity, but meat production remains high, due in particular to higher average weights than USDA estimates.

In the case of China, as of October 28, the average price was CNY 28.92, 6.5% less than the previous week. The price is 25.3% lower compared to the same week in 2019. The equivalent price in euros is 3.70 euros per kilo.

In this context of high tension in Europe, the price of pork at the Marché du Porc Breton, France's reference market, lost 4.6 cents during the week with an average price of 1.309 euros. An initial drop of 1 cent on Monday had set the tone, and the high number of pigs not bid on (30%) generated fears of further price deterioration at the end of Thursday's session. On the other hand, trade seems to be complicated by the disorganization of distribution channels, the loss of points of sale, the strong competition from foreign meat, and today's November 11 holiday.