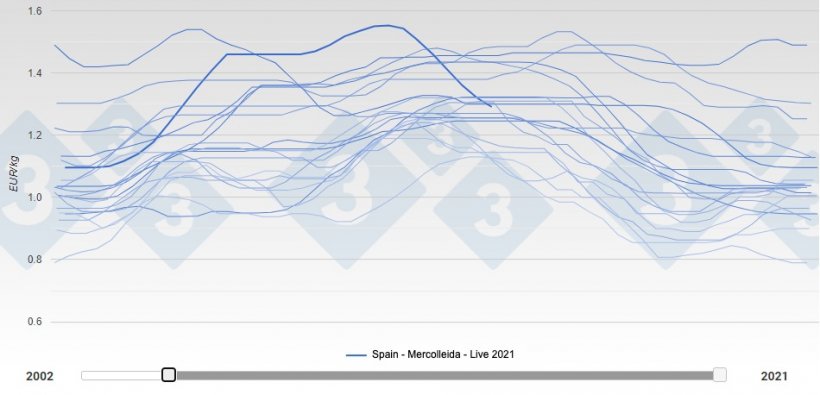

In the Mercolleida session on June 10, the Spanish price reached its highest absolute value in the last twenty years: 1.553 €/kg live. Since then, seven markets of cascading declines have gone by to situate the price at 1.291 €/kg, which represents a drop of almost 17%. We wrote just over a month ago that "pig prices must go down, keep going down, and continue to go down"; that, and that alone, is what is happening.

Spanish price down 17% in 7 weeks

We also explained in our previous commentary that Spain could not maintain a differential of 39 cents per kg live over Germany without exporting to China. At this time the differential has been reduced, but it is still at 19 cents; too high to think that our price is where it should be.

Throughout the EU, there is little slaughtering, either because of structural contraction of the herd (Germany, Belgium, Netherlands) or because of the torrid weather that slows growth (Spain, France). In spite of low slaughtering, the demand for pork is so poor that there is still a surplus, the market is apathetic and in need of a positive stimulus to instill optimism.

The recovery of self-sufficiency in China seems to be a fact. The news about floods in China that would have seriously affected its pork production is confusing and unclear. We think that, however serious the losses in some provinces may be, the impact on total Chinese production will be very limited and almost negligible, so China will remain very close to self-sufficiency.

We think that the pig price will continue to fall for a few more weeks; and at the end of August there could be markets where the price stays the same, but when September arrives and the excessive heat is history already, the supply of pigs will be very abundant (nothing new, it happens every year) and the price will fall again.

At the moment, and circumstancially, the market has an oversupply of pork but it is quite close to its equilibrium; there is very little demand but slaughterings are very low. It is worth mentioning that the Spanish processing industry has maintained pork prices in spite of the latest reductions in the pig price: a very generous attitude towards the slaughterhouses.

We must remember that Spain has a self-sufficiency level for pork of 227% (in other words, it exports 56% of its production). This exposes us to the vicissitudes of international trade.

The sudden absence of sales to China for over two months now (China continues to buy, but at a very slow pace and at very low prices) has starkly demonstrated that the Achilles heel of our export activity in Spain lies in the excessive concentration in this market. Placing 36% of our total production in China every week for months was a risk that could have consequences; we are suffering these unpleasant consequences now.

Diversify is the verb that prevails. There is no alternative. Spain will continue to produce more than twice as much as we consume, so we must continue to export and compete in the global market. As complicated as it may be, we must find new markets and defend (or increase) the market shares achieved in the traditional destinations already familiar to us. From the European Union to Southeast Asia, without forgetting America, Eastern Europe, or the Australian continent. Our market - by choice - is the world, and there is no turning back now.

The current reality in the European single market (an area in which, fortunately, all players play by the same rules) tells us that there is too much pork. And no matter how much domestic consumption grows, without sales to China there will still be pork left over. This reality implies that pig prices must go down (it is an empirical reality similar to the effects of the law of gravity). The question is to know where the ground of the decline is; we do not know anyone who is informed about this fact.

There is a surplus of pigs in the EU. This means that restructuring will have to take place. Some of us believe that this restructuring is already underway and that the shift of the center of gravity of European pig production towards Spain is inexorable and unstoppable. All the statistics point in that direction, one only needs to read and study them.

If China does not help us and come to our aid, recovering part of its massive purchases, hard times are ahead for European pig farmers. The market needs a tangible stimulus (recovery of sales to China or European consumption reaching 110% of its traditional volume, or the appearance of a magical customer who will absorb all the surpluses) which, for the moment, is nowhere to be seen. In the absence of this stimulus, the market can only go down.

We will remain watchful of developments.

We end with a quote from Victor Hugo: "The future has many names: for the weak it is the unattainable, for the fearful it is the unknown, for the courageous it is opportunity".

Guillem Burset