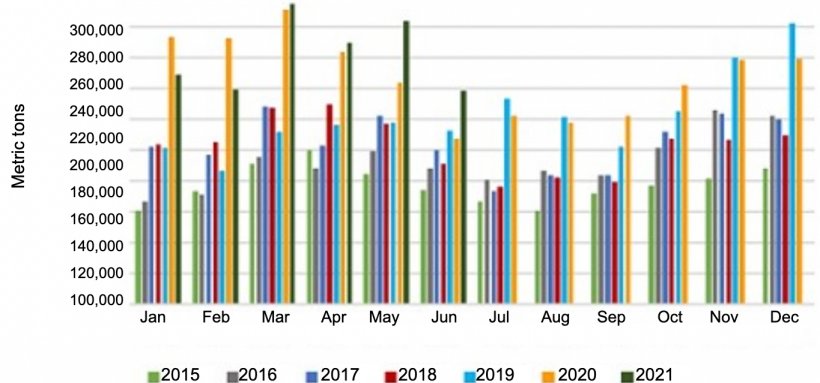

Although volume and value eased from the enormous totals posted in April and May, export value was still the highest on record for the month of June and first-half shipments established a record pace for pork exports. Pork exports reached 238,935 mt in June, up 15% from a year ago, while export value climbed 35% to $696.8 million. First-half pork exports topped last year’s record pace by 1% at 1.58 million mt, valued at $4.33 billion (up 7%).

Pork export value equated to $65.44 per head slaughtered in June, up 42% from a year ago. Per-head value averaged $67.04 in the first half, up 5%. June exports accounted for 29.4% of total pork production and 25.5% of muscle cuts, both up significantly from a year ago. In the first half, exports accounted for 31.4% of total pork production (steady with last year) and 28.1% for muscle cuts (down one-half percentage point from a year ago).

After reclaiming its position as the leading destination for U.S. pork muscle cuts in the second half of last year, Mexico emerged as the top market for total exports in June at 70,582 mt, up 45% from a year ago, while export value more than doubled to $149.4 million (up 112%). First-half exports to Mexico climbed 22% from a year ago to 396,329 mt, valued at $789.5 million (up 45%). In 2017, the record year for pork exports to Mexico, first-half volume was slightly ahead of this year’s pace at 398,565 mt, but export value is 8% higher in 2021.

Led by a near-doubling of exports to El Salvador and strong growth in mainstay markets Honduras and Guatemala, first-half pork exports to Central America topped last year’s record pace by 50% at 67,795 mt, with value up 57% to $176.6 million. Exports were also sharply higher to Costa Rica and posted year-over-year increases in Panama and Nicaragua.

Pork exports to Japan continued to gain momentum in June, increasing 40% from a year ago to 33,419 mt, valued at $138.5 million (up 29%). First-half exports were 7% ahead of last year’s pace in volume (207,699 mt) and 6% higher in value ($865.1 million). Growth was driven by increased shipments of U.S. chilled pork, as Japan’s retail demand remains robust.

Fueled in part by a temporary reduction in tariff rates, first-half exports to the Philippines more than tripled from a year ago to 58,010 mt (up 239%), valued at $176.6 million (up 257%). The Philippines has struggled with pork shortages since African swine fever (ASF) was confirmed there in 2019, resulting in a sharp decline in domestic pork production. This prompted the Philippine government to reduce duty rates on imported pork muscle cuts through January 2022, which has helped bolster demand for U.S. pork in this price-sensitive market.

Pork exports to South Korea continued to rebound in June, pushing first-half volume to 96,154 mt, up 3% from a year ago. Export value climbed 12% to $301.4 million, thanks in part to a sharp increase in chilled pork exports. Korean import data show first-half imports of chilled U.S. pork increased by 154% to 3,694 mt, valued at $21.88 million (up 170%), including a mix of belly cuts and CT butts.

After a down year in 2020, pork exports to Colombia rebounded to 46,899 mt, up 47% from a year ago. Export value climbed 54% to $108.7 million.

First-half exports to the Dominican Republic increased 38% from a year ago to 29,181 mt, with value up 49% to $71.4 million. USMEF does not expect the recent finding of ASF in the Dominican Republic to have a lasting impact on pork demand, but it could result in reduced domestic production. The U.S. is by far the top supplier of pork to the Dominican Republic, capturing 94% of the imported pork market.

While China/Hong Kong remains the largest destination for U.S. pork exports in 2021, first-half exports were down 22% from a year ago in both volume (471,565 mt) and value ($1.1 billion). Exports to China/Hong Kong accounted for just under 30% of total U.S. export volume, after reaching 39% in the first half of 2020. Although demand for muscle cuts has declined with the drop in China’s hog prices, U.S. pork variety meat exports to China increased by 25% in the first half, reaching 166,809 mt. Export value climbed 30% to $408.7 million.

August 6, 2021/ USMEF/ United States.

https://www.usmef.org/