Projections for oilseed markets

Soybean production is projected to increase by 1.1% per annum (p.a.) during the outlook period. The expansion of harvested area, including increased double-cropping in Latin America, accounts for about a quarter of global output growth. Soybean production is expected to reach 411 million metric tonnes (Mt) by 2030. Brazil is expected to be the world’s largest producer, with domestic output projected to reach 149 Mt by 2030 based on improved yields and increased cropping intensity by double cropping soybeans with maize. The United States is projected to produce 123 Mt. These two countries are expected to account for about two-thirds of world soybean production and more than 80% of global soybean exports.

Production of other oilseeds is projected to increase by 1.3% p.a. over the next decade, implying slower growth relative to the last ten years. Production growth incentives will be curbed by stagnating demand for rapeseed oil as a feedstock in European biodiesel production and the increasing competition by cereals for limited arable land in China and the European Union.

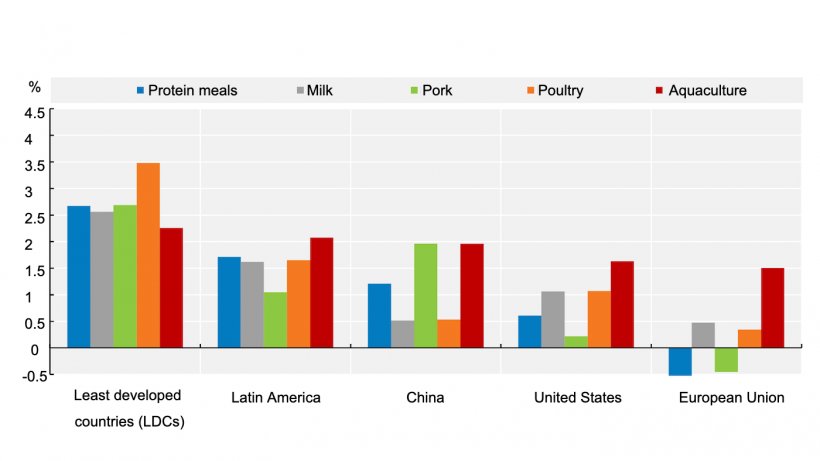

Compared to the past decade, the expansion of protein meal utilisation (1.2% p.a. vs. 3.8% p.a.) is expected to be constrained by slower growth in global pork and poultry production. Demand growth in China is expected to slow down considerably (1.2% p.a. vs. 5.7% p.a.), driven by improved feed efficiency and by efforts to adopt a lower protein meal share in livestock feed rations. China is nevertheless projected to account for about a quarter of global protein meal demand growth. In the European Union, the second largest user of protein meal, consumption is expected to decline as growth in animal production slows and other protein sources are increasingly used in feed mixtures.

Growth in world exports of soybeans, dominated by the Americas, is expected to slow considerably over the next decade due to projected slower growth in soybean imports by China.

Projections for cereal markets

Over the next ten years, a higher share of global cereal production will originate from yield growth as area expansion is expected to become more limited. Globally, average cereal yield growth is projected to be about 1% p.a. Over the next decade, cereal production is expected to increase by 336 Mt, reflecting gains made primarily in major grain-producing countries.

More than 50% of the global production increase in wheat will come from India, Russia, and Ukraine. For maize, the United States, China, and Brazil will account for more than half of the expected production increase. For other coarse grains (barley, oats, rye, sorghum, millets, and other cereals), Russia, Ukraine, Ethiopia, and India are the key producers expected to increase production.

Over the medium term, cereal demand growth should be moderate compared to the previous decade for three reasons. First, growth in feed demand is projected to slow down; second, the increase in cereal demand for biofuels and other industrial uses is projected to level off over the coming decade; and third, direct human per capita consumption of most cereals has reached saturation levels in many countries.

World cereal trade is projected to increase by 21% to reach 542 Mt by 2030. Russia surpassed the European Union in 2016 to become the largest wheat exporter and is expected to increase its lead throughout the outlook period, accounting for 22% of global exports by 2030. Concerning maize, the United States will remain the leading exporter, followed by Brazil, Ukraine, Argentina, and Russia. The European Union, Australia, and the Black Sea region are expected to continue to be the main exporters of other coarse grains.

July 5, 2021/ FAO.

http://www.fao.org/