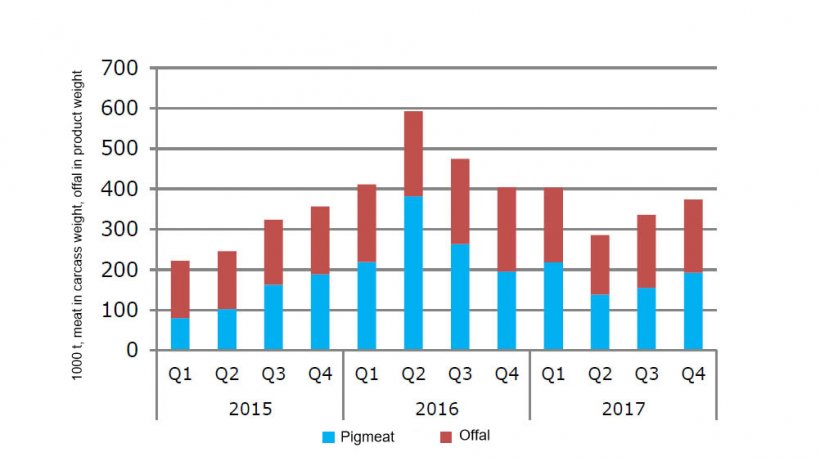

After the record level of 2016, EU pigmeat exports (carcass weight equivalent, thus without offal) decreased to 2.6 million t in 2017, a fall of 9 % in volume, but just 2 % in value thanks to higher prices. Still, shipments were 15 % above the 2015 level. The decline was driven by the reduction of exports to China (-34 %), partly offset by significant increases to other destinations such as the US (+31 %) and the Philippines (+21 %). EU pork offal exports were also affected by the reduction in Chinese demand (-16 %) falling to 1.3 million t (-6 %). EU reliance on China for pigmeat exports fell to 28 % in 2017, from 38 % the previous year, showing a certain flexibility for EU pigmeat exports in finding new markets or in increasing the share in existing markets. However, the dependence on China remained higher for offal exports (53 %). Offal represents 50 % of the volume of pork products exported to China and 34 % of total EU pork exports (21 % in value).

Since 2015 China has been restructuring its pork sector closing or relocating farms due to stricter environmental policies, while at the same time modernising its industry. As a consequence, its imports peaked in mid-2016 and then declined until the end of 2017. Only in November 2017 the trend reversed and imports are expected to stabilise in 2018. The EU is still China’s biggest supplier by far but has lost some of its share, which went from 75 % in 2015 to 65 % in 2017. All the main EU pigmeat exporters to China reduced their volumes in 2017: Spain (-9 %), Germany (-44 %), Denmark (-44 %) and the Netherlands (-28 %). Both the US and Canada increased their shares to 14 % each in 2017 (from 13 % and 8 % respectively in 2016).

In 2018 EU exports will be under pressure due to the lower prices and expected production increases in its main competitors in the world market (the US and Canada), but also in Brazil, particularly if the Russian ban on Brazilian exports is maintained. Nevertheless, EU exports are expected to rise by 2.5 % in 2018 following the growth in supply.

In December 2017 Russia lifted its sanitary ban on EU products, following the confirmation of the WTO ruling on its illegality in February 2017. However, the political ban on food products was extended until the end of 2018, and also to include offal and fat, blocking exports of most EU pork products. Following their ambitious self-sufficiency targets, pigmeat production in Russia boomed and it is likely that the country will not import significant volumes from the EU once the ban is lifted. Russian pigmeat imports declined by more than 10 % in 2015 and 2016, but picked up in the first 11 months of 2017 (+12 % year-on-year), with Brazil taking a share of around 90 % until Russia imposed a temporary ban on Brazilian meat in December 2017 out of concerns on the use of the growth promoter ractopamine. If the ban remains in force, it will contribute to support the Russian pork sector at attaining the self-sufficiency targets, even if the current spread of African Swine Fever (ASF) in Russia will play against it.

Thursday April 5, 2018/ DG for Agriculture and Rural Development/ European Union.

https://ec.europa.eu/agriculture