World supply and demand outlook

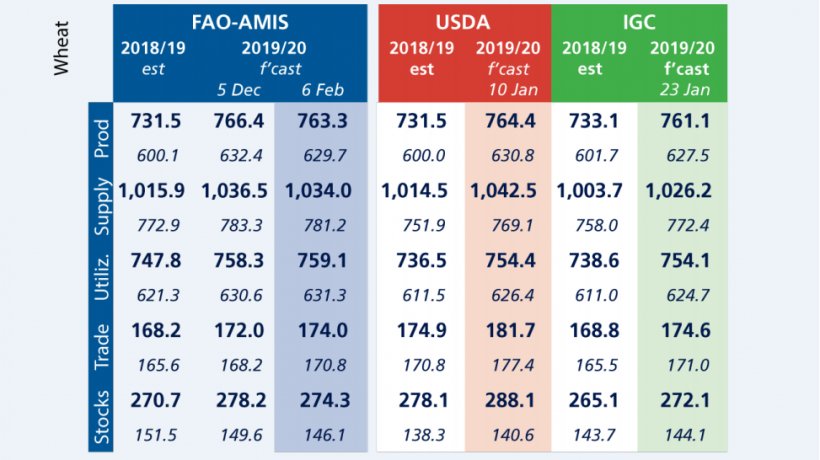

- Wheat production in 2019 is still pointing to an all-time high but has lowered since December, largely reflecting cuts in Australia and the Russian Federation. Utilization in 2019/20 raised slightly with upward corrections to feed use, which is likely to expand by 3.2 percent. Trade in 2019/20 (July/June) scaled up on expectation of larger purchases by several countries in Asia and faster pace in sales from the EU and Ukraine.

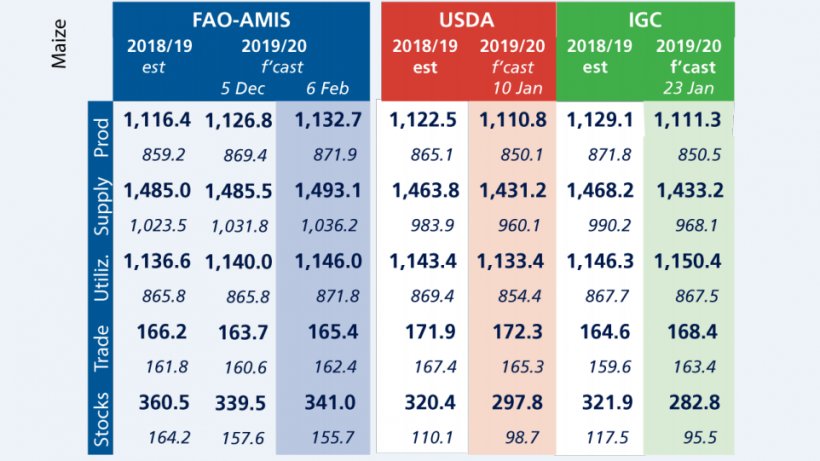

- Maize production1 in 2019 lifted since December following several upward revisions; mostly in China but also the EU, the Russian Fed. and the US. Utilization in 2019/20 is seen to expand faster than anticipated earlier, reflecting stronger feed demand, especially in the Russian Federation, the US and Viet Nam. Trade forecast for 2019/20 (July/June) is now seen to approach previous season’s record level, fuelled by stronger import demand than anticipated earlier.

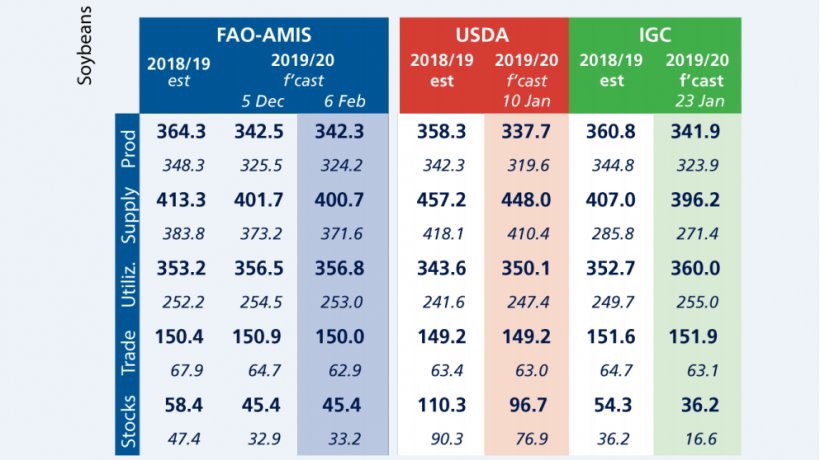

- The soybean 2019/20 production forecast is unchanged, as upward revisions for Brazil and China are outweighed by lower forecasts for India, Canada and Argentina stemming from unfavourable weather conditions. Utilization in 2019/20 raised fractionally, with downward corrections for India offset by higher forecasts for China, where pig herd rebuilding is underway. Trade forecast for 2019/20 trimmed, as downward revisions in a number of countries compensate higher import forecasts for China.

Policy developments for grain trade

On 14 December 2019, Argentina announced raising export taxes from 25 to 30 percent for soybeans, soy oil and soymeal and from 7 to 12 percent for maize and wheat. On 21 December, a bill was approved through which export taxes can be further increased to 33 percent for soybean and soybean products and to 15 percent for wheat and maize.

On 15 January, China and the US signed a wide-ranging Economic and Trade Agreement. China will increase imports of US agricultural products (including cereals, oilseeds and ethanol) by USD 32 billion higher than 2017's USD 24 billion baseline over 2020 and 2021. The two parties have agreed to refrain from further tariff escalation.

On 14 January, in view of grain shortages in the domestic market, the Russian Federation published a draft regulation concerning the introduction of an export quota until 30 June 2020 on wheat, rye, barley, oats and maize. The export quota of 20 million tonnes would apply to all countries outside the Eurasian Economic Union

Brazil and China finalised a protocol on 16 December 2019 that sets processing related safety standards for Brazilian soymeal exporters. On 31 December 2019, the Ministry of Commerce in China relaxed customs regulations for soybean imports through the regions of Heilongjiang, Inner Mongolia, and Xinjiang, allowing soybean importers to use a single import licence to clear cargoes up to six times.

1 The 2019/20 AMIS-FAO world maize production forecast includes southern hemisphere maize crops harvested in 2019 whereas IGC and USDA include southern hemisphere maize crops to be harvested in 2020 in their 2019/20 world production numbers

February 2020/ AMIS

http://www.amis-outlook.org/