This dynamic is altering the traditional flows between producing countries. France, Denmark, and the Netherlands are adjusting their exports to adapt to market developments.

Spanish imports

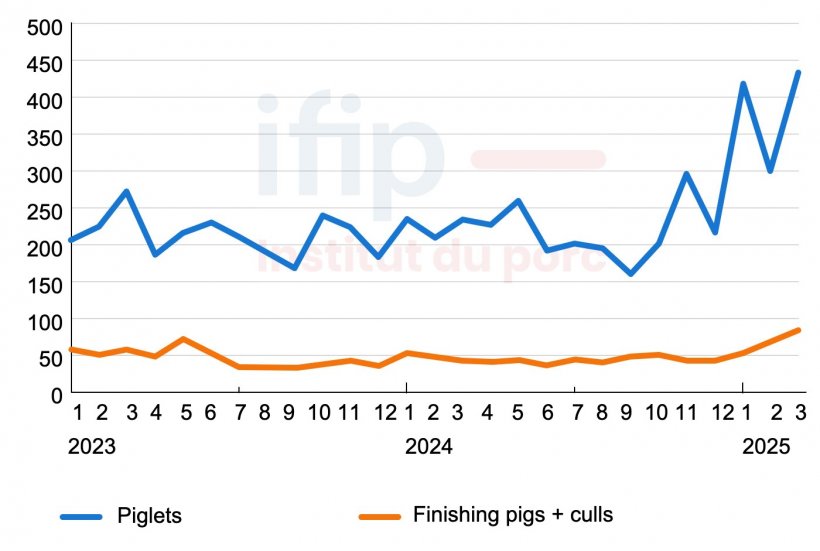

Spain's imports of live animals significantly increased in the first quarter of 2025. The European leader is increasingly resorting to live animal imports due to persistent sanitary problems (PRRS) and overcapacity in its slaughterhouses and cutting plants. In addition, the high prices on the Spanish market favor increased live pig flows to southern Europe. In the first quarter, piglet imports soared by 76% compared to 2024, reaching 1.1 million head. Purchases of finishing pigs and cull pigs also increased (+43%), totaling 62,900 animals.

Spanish monthly imports of live pigs (thousand head). Source: IFIP based on Eurostat data (customs).

The Netherlands continues to be Spain's main supplier of piglets, with 835,000 head exported in the quarter (+81% year-on-year). As for finishing pigs, Belgium shipped 66,400 animals (+707%) and France shipped 25,500 animals (+711%). For economic and structural reasons, Portugal maintains a steady flow of live pig exports to Spain. These shipments intensified at the beginning of the year (+112%) and reached 62,800 head.

French exports increase

France's exports of finishing pigs increased by 41.5% during the first three months of 2025, reaching 89,500 head. Despite this increase, these flows remain marginal. Each month, finishing pig exports account for less than 2% of domestic slaughter. In March, for example, 30,500 finishing pigs were exported to the EU. The main destinations were Belgium (+2.7%) and Spain (+711%). As for piglets, French exports were minimal (2,200 head in the first quarter).

Northern Europe reorganizes its live pig trade

In northern Europe, the restructuring of pig production chains in recent years has led to a shift in live animal flows. Since 2020, German demand has fallen sharply, forcing the diversion of Danish and Dutch live pigs to other destinations. Since 2024, the German market has been in the process of rebalancing, but the appearance of a case of foot-and-mouth disease in early January in Germany temporarily disrupted the live pig trade in the area. In the first quarter, German pig imports decreased again (-1.6%), especially between January and February, a period during which restriction zones and limitations were imposed on the transport of live animals.

In Denmark, sales of live pigs increased by 3% in the first quarter of 2025, mainly in the piglet category. Piglet exports grew to the German (+1.1%) and Polish (+13.4%) markets.

In the Netherlands, the domestic market has seen a marked reduction in its pig supply in recent months. Slaughter fell by 7.7% during the first four months of the year compared to the previous year. The restructuring of the slaughtering sector in the north of the EU and price differences at the European level are changing trade flows. In addition, the continuation of government policies aimed at encouraging the cessation of livestock farming is reinforcing the fall in the supply of finishing pigs, a dynamic that is likely to continue in the coming months in the Netherlands. Thus, piglet exports increased by 18%, while finishing pig exports fell by 19%. This dynamic in piglets is mainly driven by Spanish demand, while shipments to Germany are down due to transport restrictions associated with foot-and-mouth disease detected at the beginning of the year.

European importers of live pigs in the first quarter of 2025 vs. 2024 (million head). Source: IFIP based on Eurostat data (customs).

Thus, European pig trade data confirm that Spain's import dynamics continued during the first quarter. On the other hand, live animal flows continue to be polarized towards Germany. Despite the sanitary disturbances that occurred at the beginning of the year, the German market remains a major importer, with 3 million pigs imported. In comparison, Spain imported 520,000 head during the first quarter. Finally, exports from France, the Netherlands, and Denmark continue to grow, although with contrasting dynamics depending on the number of animals involved, the type of pig, and the partner countries.

Elisa Husson,

Economist ‘Place des Marchés’ by IFIP