One of the main objectives of the agreement is to eliminate almost 90% of tariffs between both parties, progressively over 10 years, with some exceptions that will extend up to 15 years. It is worth clarifying that, although the agreement has already been signed, it is still subject to the ratification process by the European institutions and the national parliaments of the member states, so this process could take several months or even years.

The agreement will significantly impact pork and, as expected, has provoked divided opinions among swine industry representatives in both regions. While some view it as an opportunity, others consider it a risk due to regulatory and economic imbalances.

Current context of the international pork trade for the parties

Before analyzing the agreement's effects on our industry, we need to contextualize the current state of pork trade in both blocs. To this end, the following is a brief analysis of both parties' international trade volumes and flows.

European Union

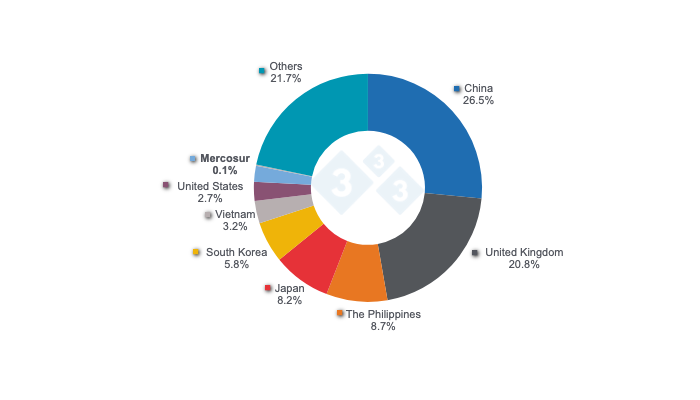

The EU stands out as the leading exporter of pork globally, followed by the United States and Brazil. In 2024, the EU exported a total of 4.35 million tons of pork products. Last year, its main destinations were China and the United Kingdom, while Mercosur accounted for just 0.17% of the overall total (Figure 1).

Graph 1. Top destinations for EU pork exports in 2024, including data for MERCOSUR. Source: 333 based on Eurostat data.

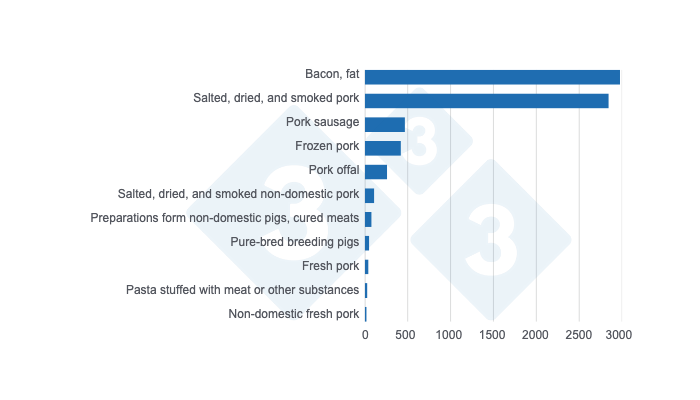

Regarding shipments to Mercosur countries, the leading destinations were Uruguay (3453 t, 47% of total exports to Mercosur) and Brazil (2979 t, 41%), and to a lesser extent, Argentina (861 t, 12%), and Paraguay (17 t, 0.2%). The products the EU supplies to Mercosur are generally value-added, such as salted and smoked products, although there are also significant shipments of pork fat (Figure 2).

Graph 2. Exports of pork products and by-products from the European Union to MERCOSUR in 2024, in tons. Source: 333 based on Eurostat data.

As for pork imports, the volume is minimal. In 2024, the EU imported 160,947 tons, mostly from the United Kingdom (67%). Of the total, only 25 tons came from the countries that make up Mercosur, accounting for just 0.02% of EU pork imports. Notably, Brazil played a significant role, representing 64% of Mercosur's total exports to the EU, with 16 tons.

Mercosur

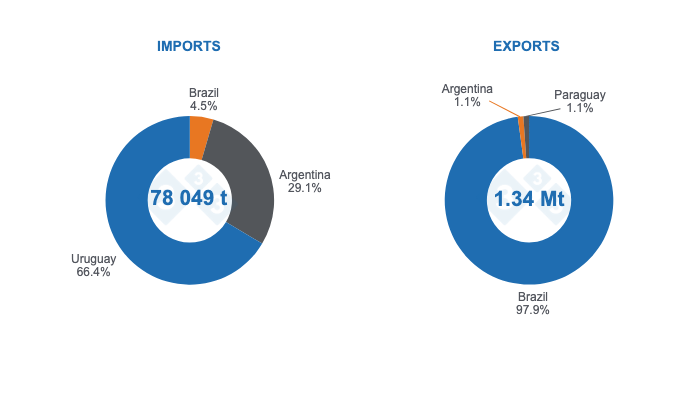

Although Mercosur refers to a bloc made up of Brazil, Argentina, Paraguay, and Uruguay, it is important to mention the marked differences between these countries, since the advantages and disadvantages of the agreement could have a different impact on each member country. The following is a brief description of the international pork trade for each country:

- Brazil, the largest country in Latin America, is the world's fourth-largest pork exporter. In 2024, it saw record pork exports, which exceeded 1.3 million tons, 30% of which were sent to China. Brazil is currently authorized to ship its pork to more than 89 countries, with 90% of its exports corresponding to pork cuts. As for shipments to the EU, these represent only 1% of the overall total, while imports from the EU are also minimal and correspond to salted and smoked items.

- Argentina is a country with great potential; in fact, in recent years it has experienced a change in policies that have permeated the macroeconomic environment, including a significant reduction in inflation and the fiscal deficit, as well as the elimination of barriers to international trade. As for swine production, in 2024, pork production grew 3% and reached 785,000 tons, while imports last year saw a year-on-year growth of 38% with 22,000 tons, of which 95% came from Brazil and the remaining 5% from countries such as Chile and Paraguay. Pork exports increased by 30% last year, reaching almost 30,000 tons. Argentina currently has 41 authorized export destinations for pork exports.

Graph 3. International pork trade in MERCOSUR for 2024 and participation of member countries. Source: 333 based on data from Comexstat, SAGyP, OPYPA, and ACCP.

- Despite being a very small country geographically, Paraguay has great export capacity. In 2024, it exported more than 15,000 tons of pork, with Taiwan being its main trading partner with 64% of pork exports. It also has a strong dynamic in Mercosur intraregional trade, with 17% of its exports in the last year going to Uruguay, 12% to Brazil, and 4% to Argentina. The most exported products are frozen pork (72%) and casings (17%).

- Uruguay's domestic consumption is comprised of 80% imported pork. Its main suppliers of frozen pork are precisely Mercosur countries, Brazil (96%) and Paraguay (2%), while fat imports come mainly from Spain (36%), Chile (19%), and Paraguay (18%).

Challenges and opportunities of the agreement, parties' perceptions

The potential of this negotiation for the swine industry is enormous. In addition to transforming and significantly increasing pork trade between the two regions, it has the capacity to generate important exchanges in areas such as technology transfer, animal welfare, and sustainability, especially from the EU to Mercosur, also attracting large investments.

On the other hand, the EU could benefit by increasing its market share in Latin America and gaining access to raw materials at a relatively low cost, since Brazil and Argentina are two of the world's leading producers of corn and soybeans.

Now let's take a closer look at the possible effects for the parties.

European Union

Within the EU, the effects of the agreement will be different for each Member State as they will depend on factors such as the structure of their production, their export orientation, and their dependence on raw materials.

Overall, the opening of this new market may not represent a significant change in terms of export volume, since, as mentioned above, Mercosur has robust pork production and consolidated intra-regional trade. Where there could be growth opportunities is in the export of high value-added products. European processed meat, cured sausages, and other pork products are globally recognized for their quality and tradition. Until now, exports of these products to Mercosur have been limited due to high tariffs and trade barriers. With the agreement, the reduction or elimination of these tariffs could facilitate access to Mercosur consumers, especially in premium markets and sectors with high purchasing power, which seek products differentiated in taste, quality, and sanitary certifications.

However, this opening also entails risks for European producers. Mercosur is a highly competitive region in terms of production costs, due to factors such as access to cheaper raw materials (mainly soybeans and corn for animal feed), lower environmental and animal welfare regulations, and lower labor costs. This raises concerns within the European swine industry, which already operates under strict regulatory standards and faces profitability challenges.

In this regard, although the agreement maintains the EU's high sanitary, welfare, and sustainability standards intact, it could generate unequal competition between European and Mercosur producers due to structural differences in production costs and internal regulations. The application of safeguard clauses, the reinforcement of controls on compliance with sanitary and sustainability standards, as well as the implementation of certifications aligned with European standards, will be key aspects to avoid a negative impact on EU pig farming.

Another aspect to consider is the supply of raw materials. Soybeans, the main agricultural product that the EU imports from Mercosur, along with its derivatives (soybean meal and oil), already enter the European market with zero or very low tariffs in the case of derivatives. However, given the EU's high dependence on these imports, the agreement could benefit European livestock by guaranteeing a more stable supply for use in feed production.

Mercosur

Although Mercosur theoretically functions as an economic bloc, a review of the specific characteristics of the pork market in each member country reveals significant differences. From Brazil’s large volume and variety of export destinations to Argentina’s strong potential and solid infrastructure, Paraguay’s export-oriented approach, and Uruguay’s reliance on imports to meet domestic demand. In this sense, the effects and benefits of the agreement with the EU will be very different for each country.

In addition, intra-regional trade in Mercosur is very dynamic in the swine industry, as discussed earlier. This characteristic could limit, to some extent, the entry of EU pork, since Mercosur has a robust and competitive intraregional supply and satisfied demand. However, the EU could increase its exports of processed products such as salted and smoked products, access to which is currently limited due to high costs, restricting consumption to a select group of consumers. The entry of these duty-free products would contribute to diversifying the gastronomic offer in a culture that, although very traditional, is looking for new food options.

On the other hand, Mercosur's opportunities to enter the EU with pork and pork by-products could stimulate the expansion of pig farming and the growth of local production destined exclusively to cover this new trading partner. However, although the Mercosur product would be more competitive in theory in terms of price-cost ratio, there are non-tariff barriers that would greatly limit access to this market. Among these barriers are strict regulations on crucial issues such as animal welfare, sustainability, labeling, and biosecurity. At present, even the large producers in Mercosur countries are only beginning to take the first steps toward complying with these standards.

This raises an important question: Is it enough for Mercosur producers to adapt their farms and production systems to the European Union’s high standards, driven mainly by the incentive of market access? Or are legal agreements and national-level regulations also needed to meet these standards and harmonize requirements for both sides? This is a major concern, especially from the perspective of the imbalance that could arise, given the strict regulations imposed on European producers compared to the current regulatory framework in Mercosur countries.

One of the possible future consequences of the implementation of this agreement in Mercosur could be the transformation of the swine industry in the region, driven by the EU's advanced regulations. These regulations could indirectly contribute to reshaping the pig production model and contribute to the adoption of technological innovations, genetic improvements, sustainable practices, and other aspects in which the EU is superior and about which Mercosur countries still have much to learn. Thanks to this agreement, joint projects could be developed that would allow the transfer of knowledge, resulting in industry advancement.

Table 1. Parallel challenges, risks, and opportunities of the pork trade between the European Union and Mercosur, derived from the agreement.

EUROPEAN UNION |

MERCOSUR |

|

|---|---|---|

| OPPORTUNITIES |

|

|

| CHALLENGES AND RISKS |

|

|

| FUTURE SCENARIOS |

|

|

Source: 333