Overall industry performance in 2024

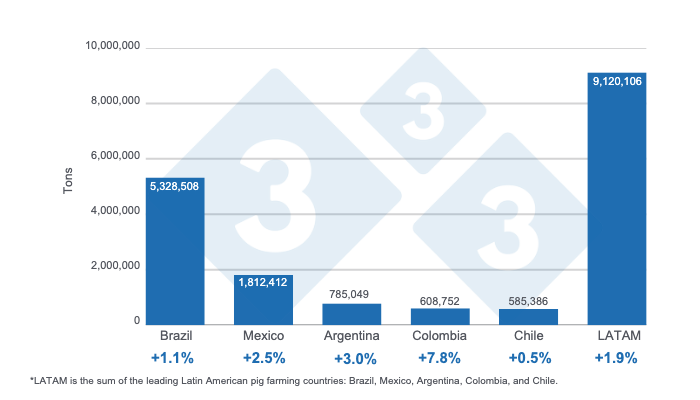

To give context, let’s look at the results of the key variables and the standout characteristics of the region's five leading countries, which account for nearly 95% of total production volume. In the past year, they consolidated 9.1 million tonnes (Mt), reflecting a 1.9% growth compared to 2023.

Graph 1. Pork production in 2024 for leading Latin American countries and regional total, annual variations. Prepared by 333 Latin America with data from IBGE, SIAP, SAGyP, Porkcolombia, and ODEPA.

Brazil's pork exports reached record highs (1.3 Mt), up nearly 10%, suggesting high competitiveness in supplying international pork demand. However, this increase in exports seems to have contributed to a decrease in domestic consumption, despite a slight 1.1% increase in pork production, which reached 5.3 Mt in 2024.

Although Mexico's domestic production increased by 2.5%, reaching 1.8 Mt, it depended significantly on pork imports, which were supplied mainly by the United States. Imports reached record highs again (1.73 Mt) and represented nearly 52% of domestic pork consumption. Exports fell by 12% and reached 188,629 t. However, the increase in export prices helped mitigate the drop in volume.

In Argentina, domestic consumption was the main driver of growth in pork production, which reached 785,049 t, a 3% increase compared to 2023. Despite the macroeconomic challenges and the vigorous increase in imports totaling 22,674 t, domestic production grew significantly, supported in part by a gradual recovery in exports, which grew by 30.2% in the last year.

Colombia continued to lead pork production growth in the region with an annual increase of 7.8% and a record volume of 608,752 tons, which moved it up to fourth place in the ranking of Latin American pork producers, displacing Chile to fifth place. Colombia's outlook for the swine industry is very optimistic, as sustained growth is expected in the short, medium, and long term.

Finally, Chile's domestic pork consumption recovered, supported by a slight increase of 0.5% in pork production and a significant increase in imports (18.1%). The 2.1% decrease in exports also suggests a focus on meeting domestic demand, which returned to levels above 448,000 t, a figure not reached since 2022.

What can we expect in 2025?

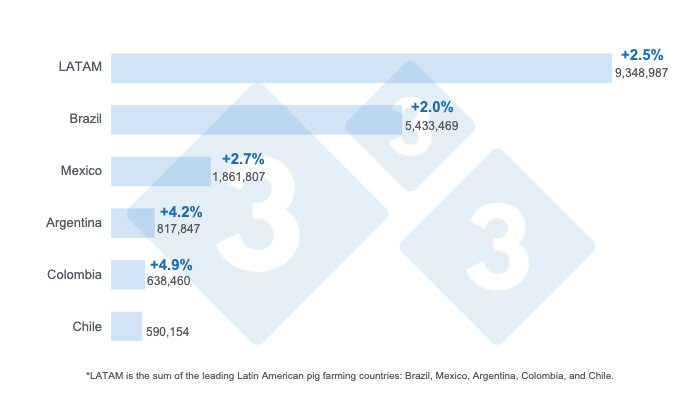

Graph 2. 333 LATAM projections for pork production in 2025 in the leading Latin American countries and the regional total. Figures in tons and estimated percentage growth with respect to 2024. Prepared by 333 Latin America with own data.

At the regional level, we expect pork production to continue to grow to reach 9.3 Mt in 2025, according to our estimates. However, we will face a major shock from the imposition of tariffs on pork by the United States, which could reshape international trade flows and even domestic production levels, so we would have to adapt to a new market reality.

Brazil is once again expected to see significant growth in its pork exports, thanks to the competitiveness of its product, as well as to the more than 89 countries that have authorized Brazil as their supplier of imported pork. Furthermore, the current “tariff war” between the United States and several of its traditional trading partners could present great opportunities to expand this Latin American giant's participation as a pork supplier to countries such as Mexico and China, among many others. Therefore, according to our estimates, pork production would reach 5.4 Mt, supported by higher demand, both domestically and abroad, throughout the year.

Mexico would be significantly affected by the imposition of tariffs by the United States, its main supplier of imported pork, and by the retaliatory measures adopted by its national government. In view of this, we could foresee two possible scenarios, the first of which would be the diversification of its commercial partners to substitute, in part, what would no longer be imported and exported to and from the United States, or also, an import substitution plan could be implemented, increasing domestic pork production - although the results of this would not be immediate and would only be seen in the long term. One thing we are sure of is that domestic demand for pork in Mexico is very strong and domestic consumption is growing steadily. So, there is a large market waiting to be served either through imports or domestic production. Now, according to our projections, domestic pork production in Mexico for 2025 would be around 1.7 Mt. Taking into account the share of imports in domestic consumption, about 1.8 Mt would be needed from abroad to cover domestic consumption.

In Argentina, as the various government measures that impact the macroeconomic environment and international trade continue to take effect, the outlook for the swine industry is expected to continue to improve. In this regard, we estimate pork production close to 820,000 t in 2025 and expect a gradual recovery of exports. We must also take into account the strength of domestic pork consumption in Argentina, given its competitiveness compared to other proteins, which is why the volume of imports could experience a considerable increase to supply the growing domestic demand.

In Colombia, we expect the swine industry to continue to perform very well and to continue to expand, achieving a greater market share thanks to increased consumption. We also estimate that production will again set a record, reaching around 640,000 t in 2025.

Finally, for Chile, we forecast production of 590,000 t, with a slight increase of 0.8% compared to 2024. Swine farming will continue to be overshadowed by adopting new environmental regulations, which would increase production costs for compliance and also limit the increase in production.

Conclusion

2024 was a very positive year for Latin American pork production. The strong demand for pork continued to be driven by domestic consumption and allowed for a significant volume of imports, without significantly undermining local productions. Likewise, there was evidence of new escalations and incursions of Latin American pork into world markets, which is a clear sign of the competitiveness of our pork exports; there is still a long way to go in this aspect, but we are on the right track.

In 2025, our sector will continue to grow while facing major challenges. Once again, the geopolitical environment apparently plays against us. However, I am convinced that every crisis leads directly or indirectly to a new opportunity and perhaps this possible reconfiguration of trade flows could be an incentive to further diversify supply and demand interactions with new trading partners and even to increase our local production.