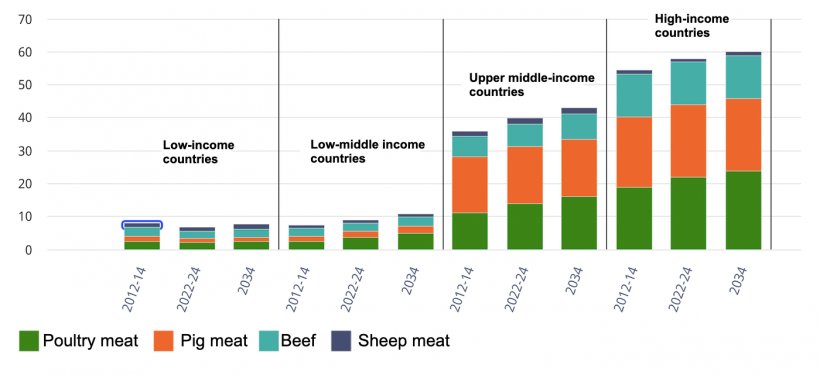

Total growth in meat consumption is projected at 47.9 Mt over the next decade. Global poultry, sheep meat, beef, and pig meat consumption is projected to grow by roughly 21%, 16%, 13%, and 5% respectively by 2034. Annual per capita consumption is projected to increase by 0.9 kg per capita/year edible retail weight equivalent (rwe) by 2034. In high-income countries, consumers are increasingly sensitive to animal welfare, environmental and health concerns, leading in some instances, per capita meat consumption to stagnate.

Pig meat consumption is projected to grow in all regions, except in China, the European Union, Japan and Switzerland, where consumption is already high, and health, environmental and societal concerns increasingly influence diets. Pig meat will be the third largest contributor to the total growth in meat consumption and is projected to reach 130 Mt carcass weight equivalent (cwe). However, global per capita pork consumption is projected to decline by 4% relative to the base period for the Outlook due to zero growth in per capita consumption in high-income regions, alongside a rapid population increase in regions where pork is not commonly consumed. In the Latin American region, per capita consumption is projected to increase the most, by 1.3 kg/year rwe, due to favourable relative pig meat/beef prices. In other regions, per capita consumption is anticipated to grow less or even slightly decline such as in Asia, North America and the European Union.

Improvements in breeding efficiency and slaughter yields are projected to mitigate the environmental impact of meat production. Globally, improved slaughter weights will account for 8%, 27% and 19% of the gains in bovine, pig meat, and poultry meat production. With these productivity improvements and a greater share of poultry in meat production, greenhouse gas emissions are expected to rise by 6%, significantly less than the projected 13% growth in meat output over the coming decade.

The decreasing role of China in meat imports is expected to shift global trade patterns. By 2034, China’s share of global meat imports is set to decline from 20% in the base period to 16%. A reduced reliance on pig meat imports has led to curbed pork production in major exporters. A similar downward trend is evident in China’s poultry imports. Global meat imports will grow by just 10% compared to 37% in the previous decade, with considerable downside risk if countries retrench on trade measures.

Recent animal disease outbreaks have highlighted the critical need for biosecurity collaboration in the meat industry. Animal disease outbreaks continue to disrupt the meat sector significantly, emphasizing the need for collaborative biosecurity to maintain industry sustainability. The continuous evolution and spread of animal diseases such as HPAI virus, ongoing ASF, resurgence of Foot and Mouth Disease (FMD), and the New World Screwworm (NWS) cast uncertainties for the medium term.

July 15, 2025/ OECD.

https://www.oecd.org