When global supplies of pork are large, as they are now, the name of the game for major production areas is growing net exports (exports less imports). Most major pork production areas of the world have topped out some time ago on production capacity sufficient to satisfy their local and near-region demand. Now these areas require stable to slowly growing demand through increases in net exports in order to keep their industries healthy and viable. The global economic slowdown and the strategic oil pumping battle led by the Saudi’s to crush US and Canadian shale developers has combined to push commodity prices to decade or more lows. This has helped keep feed, shipping and utilities down and mitigated some of the bloodshed but prices have now fallen in the US into loss zone.

As I mentioned last time, the US Federal Reserve led by Janet Yellen has been defying, month-by-month, an expected nudging up of US interest rates from their current zero level. There is quite an argument regarding whether or not the strength of the underlying US economy justifies even a small uptick but the near consensus is that some adjustment room needs to be gradually restored to monetary policy or there will be very little that can be done to bolster a new decline in US economic activity whether it is business related or due even to a major terrorist attack, for instance. Couple that with the fact that we are in the Presidential contest year and the political overtones of any move by Yellen are huge though she and her board of governors are supposed to be strictly independent.

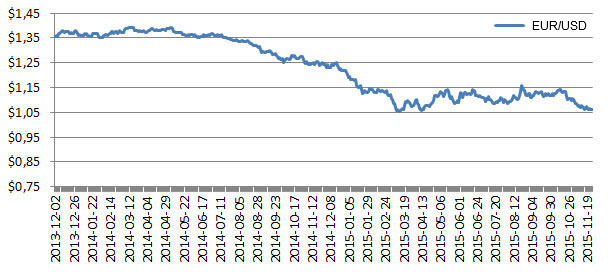

Nevertheless, just the threat or expectation of marginally rising interest rates in a global environment where significant new business activity is hard to find has been attracting global investors toward the US dollar as a source of safe returns. The alternatives just look anemic. A look at the resulting fall of the value of the Euro against the US dollar over the last two years is startling and explains why excess pork production in the EU is moving out to foreign buyers in China and elsewhere while US exports are languishing and gradually sliding back.

Two years ago at the beginning of December 2013, the Euro traded for $1.35 USD. One year ago in early December it traded for $1.25USD and now it trades at $1.06USD. The relative purchasing power shift has been enormous in favor of buying from EURO countries, an improvement in purchasing power vs the USD of over 20%. The full value of this has likely been realized too as the Eurozone inflation rate has fallen over the same two year period from nearly 2% annual rate at the end of 2013 to completely flat or slightly deflationary during 2015. While individual items may buck the trend of the average, the general picture is clear. No run up in real or nominal prices for EURO denominated goods but when I buy EUROS to spend there, I get a lot more of them for the same outlay in my home currency. Let’s go shopping.

Fig. 1 Less dollars required to buy a EURO

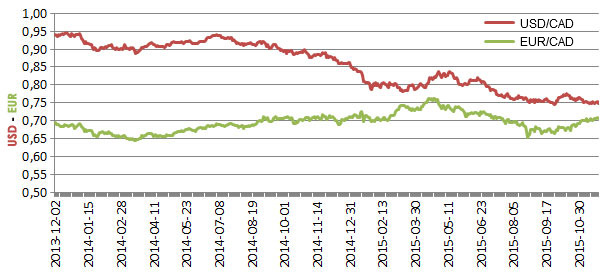

It doesn’t work that way for every country however. When commodities are in demand worldwide, Canada is a basic materials powerhouse and the Canadian dollar will soar. In the last two years with nothing going on, the Canadian dollar has fallen like the EURO from about $0.94 USD to $0.74 USD but it has actually gained a few cents against the EURO over this same period.

Fig. 2 Canadian dollar falling against US dollar but stable to rising against the EURO

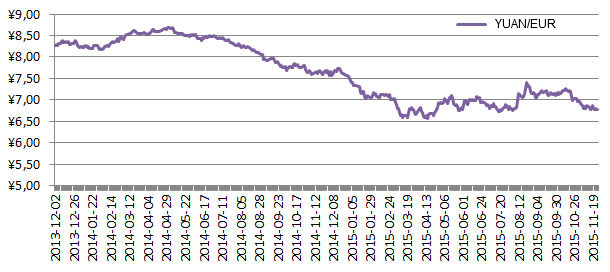

Now consider our friends in China over the same two year period. Two years ago they had to pay about 8.25 Yuan to get 1 EURO; today it’s only 6.75 Yuan to get the same purchasing power or more when buying Euro denominated pork.

Fig. 3 Less Yuan required to buy a EURO

The circle is complete when you realize that Canada produces very high quality pork and sits on the northern border to the USA. This has caused the double whammy for the US in that our foreign sales are slumping due to the relative price increase and we can’t resist bargain hunting on Canadian pork products whose relative prices have fallen. Total exports down and total imports on the rise creates a massive block on future profitability for the US industry as total supplies are rising and more than adequate and if they do not move a little faster to foreign ports, the counter cyclical threat mentioned last time could ruin the normal summer profitability. Lots of factors in the mix these days but global exchange rates are dominating the picture today in determining where the sun shines on pork producers.

An interesting side note we may talk about later is the investment by JBS SA in Brazil in new processing capability and some very high tech carcass fabrication equipment. It’s the beginning of precision agriculture working up the chain to the packing sector. The tipping point finally comes when no matter how cheap the labor is, the consistency of the precision fabrication of the carcass (in this case), which changes with the relative price of the primal cuts, is not only a cost saver even when labor is cheap but a revenue enhancement too. Behold your future. Labor is disappearing. Better to focus on knowledge. Knowledge is here to stay.