According the European Union agricultural outlook for 2020-30 report, sustainability concerns are expected to drive EU meat markets over the coming decade, pushing lower consumption per capita, more efficient production systems with fewer animals, and reduced exports of live animals. Overall, EU meat consumption per capita is projected to decline by 1.1 kg, reaching 67.6kg by 2030.

EU pigmeat production and consumption falling

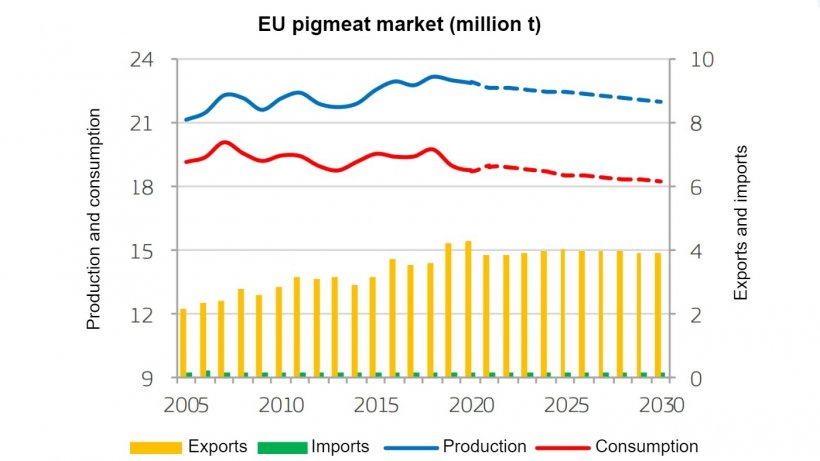

Environmental concerns in several EU Member States, coupled with the risk of ASF and changes in consumers’ preferences are likely to constrain EU pigmeat production in the medium term. It is expected to fall by 1 million t (-4.6%) between 2020 and 2030. The global pigmeat market will continue to add uncertainty to production and to the availability of meat for consumption in the EU. For instance, EU production did not rise in 2020 due to the unfavourable investment climate, despite the peak in world demand and favourable prices.

EU per capita pigmeat consumption started to decline in 2019, when the EU redirected a large share of pigmeat production to China while domestic prices were high; this caused consumers to switch to cheaper alternatives. The decline is set to continue after a short recovery in 2021, to 32 kg per capita by 2030 (1.4 kg less than 2020). EU consumers may not return to pigmeat and instead are likely to favour poultry meat.

Impact of ASF on pigmeat market: EU trade stagnation

The global and EU pigmeat market remains uncertain due to the continuous but diminishing impact of ASF in Asia. Firstly, production potential in Asian countries may improve faster than expected. In China, after 2 years of shortages and high prices, which have attracted massive shipments, import demand is set to drop markedly in 2021, and pigmeat production may reach pre-ASF levels by 2025 if the restructuring of its pigmeat industry is successful. Secondly, the ASF-related import bans have intensified in Asian countries after the outbreak in Germany in September 2020 and will bring the large outflow of EU pigmeat to a halt in 2021.

In any case, EU pigmeat exports, which have already peaked in 2019-2020, will not rebound as Chinese demand recedes. By 2030, EU exports may remain slightly higher than in 2018, thanks to demand from other Asian partners who might not manage to recover entirely from ASF. Overall, the EU will remain the global leader in pigmeat exports (38%).

EU pigmeat prices to return slowly to current levels

EU pigmeat prices reached a peak in 2019 due to the massive demand from China, while COVID-19 and the ASF-related import bans on German pigmeat contributed to a decline in 2020. Global competition (from the US, Brazil and Canada) and the ASF-related loss of demand for EU meat will cause further falls in prices. As availability will decrease, EU prices should recover to around EUR 1 600/t by 2030.

December 16, 2020/ European Commission/ European Union.

https://ec.europa.eu/