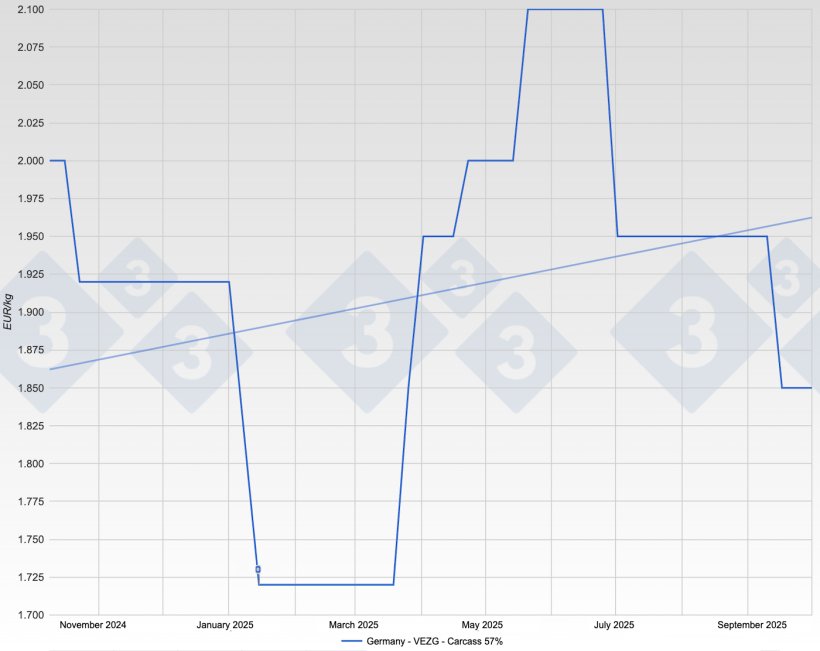

September felt like a long, deep breath on the German pig market, a quiet pause between the end of summer and the beginning of autumn. At the start of the month, producers held their line. The quotation stood at 1.95 €, and the market appeared remarkably calm. Only gradually did sentiment begin to shift. As retail demand for meat weakened and the barbecue season came to a clear end, the market lost its momentum. By mid-month, the official reference price had slipped to 1.85 €, where it remained after this noticeable correction. This mirrored the situation in farms and slaughterhouses, where animals were moved smoothly but demand failed to gain traction. In the second half of September, the price reports confirmed a muted overall situation at 1.85 €.

The tone in the piglet market shifted in parallel. At the beginning of the month, conditions were still balanced, with the 25-kilogram standard around 61.50 €. But as finishers became more cautious, prices started to fall. First to 59.00 €, and by the end of the month to 54.00 €. The clear decline reflected how sensitively the upstream market reacted to the sluggish meat trade.

For sows, the market remained largely steady before softening slightly. After starting at 1.05 €, the official quotation dropped to 1.00 € by mid-September. The available supply was fully marketable, but sellers continued to wait for stronger demand from the processing segment.

Political and structural developments formed a quiet but constant background

In Hesse, the ASF-protection-fence set up the previous year in the Pfungstädter Moor was dismantled in September. It was only a small step in managing the disease but symbolized a return to more normal operations in a region that had to remain particularly vigilant for some time.

A far louder signal came from China. Starting on 10 September, Beijing introduced a deposit tariff on European pork. Rates differ widely between companies and can exceed thirty percent, while firms without an individual rate must pay even higher deposits. The measure affects an already reduced export flow and is viewed within the industry as a response to European tariffs on cars. Germany remains excluded from direct trade with China due to African Swine Fever, but the repercussions are felt throughout Europe, dampening confidence and putting pressure on sentiment.

Observers noted increasing tension within the European Union as September progressed. Competition between member states intensified, and buyers’ restraint was mentioned more frequently. The public holiday in the final week, which reduced slaughter capacity, did nothing to improve the mood.

On an international level, the month reflected a phase in which global political actions and European production paths became more closely intertwined.

According to ISN forecasts, EU pork production is likely to decline further, as sow inventories have already decreased in livestock surveys. For Germany, 2025 still points to stable slaughter numbers but fewer imported live animals. This suggests a moderate supply situation and potential support once demand picks up again.

What does all this mean for the outlook in the coming weeks?

First, the current weakness in piglet prices is unlikely to last once finishers resume placements with more confidence and the meat trade widens its product range for autumn. Limited sow herds and the prospect of lower EU production support this view.

Second, the German slaughter pig market remains sensitive to consumer sentiment. Stronger demand for cuts or sausages as temperatures fall could quickly create bottlenecks. That would bring the desired demand impulse, but the current European surplus is waiting to fill any gaps.

Third, the global trade situation remains an uncertainty and, for now, more of a brake than a boost. China’s advance tariffs are hitting Europe hard and shifting significant volumes within the internal market. The additional pork weighs on prices and increases competition among processors. Even though Germany itself is not directly involved in exports to China, the market feels the consequences through falling revenues and rising supply pressure. Domestic demand remains steady but is not strong enough to absorb the accumulated volumes. As a result, autumn is unlikely to bring much relief. In the short term, full cold stores and ample EU supply point to further difficult weeks with continuing price pressure before any recovery can take hold.

In short: September brought falling pig prices to 1.85 €, declining piglet prices, and noticeably more cautious demand. Across Europe, the large volume of pork continues to weigh on the market and limits any price optimism. While Germany’s limited live supply provides some longer-term support, the short-term picture remains difficult. Slaughter companies are operating in a highly competitive environment, and sales are sluggish in many regions. The coming weeks will show whether retail demand can generate enough momentum to ease the pressure. Otherwise, both producers and traders may face another round of challenging weeks. For now, it also seems unlikely that China will withdraw its tariffs, as the government in Beijing is currently focused on reducing its own domestic oversupply.