Swine production grows to meet demand

In marketing year (MY) 2021, Mexico’s swine production is forecast to be 20.8 million head, as demand for pork meat increases in Mexico and globally. (A slight increase from the anticipated 2020 production of 20.275 million head.) Mexico’s swine producers continue to vertically integrate production chains, invest in technology, and implement biosafety measures to reduce swine mortality at farms.

Consumer demand evolves in favor of affordable protein

In MY 2021, Mexico’s pork production is predicted to be 1.53 million MT. Retail consumer demand for pork meat continues driving pork production increases in Mexico. Changing retail consumer trends toward more affordable animal proteins continue to increase demand for pork cuts and pork-based products. Mexico’s TIF establishments were able to maintain uninterrupted pork production due to timely implementation of sanitary protocols in as preventive measures to possible COVID-19 outbreaks at plants and resulting plant closures.

Mexico’s pork consumption is expected to be 2.15 million MT in 2021. Mexican consumers’ buying habits have changed. Versatility, convenience, flavor, and a variety of choices have become the trend among the expanding urban middle class, driven by pressure to save time, seek added value, and have greater convenience in heating and serving meals. However, in more rural areas, backyard slaughter for household consumption continues to be prevalent.

Continued global opportunities for pork trade

Mexico’s live swine imports are expected to be at 40,000 head in 2021, driven by the need for better herd genetics and for breeding purposes. As Mexico’s macroeconomic situation is worsened by the COVID-19 pandemic, producers’ capacity for continued investment in better genetics is decreased. This will be reflected in reduced imports in the fourth quarter of 2020 and through 2021. The United States is the main provider of live swine to Mexico followed by Canada.

In MY 2021, Mexico’s pork imports are forecast at 960,000 MT. Mexico heavily depends on U.S. pork imports to satisfy domestic demand. However, the COVID-19 pandemic measures enacted in Mexico and the United States negatively affected Mexico’s pork import figures in the first and second quarters of 2020. In MY 2021, Mexico should see a small rebound on pork imports as the hotel, restaurant and institutional service industry begins to open up and that sector's demand for pork increases.

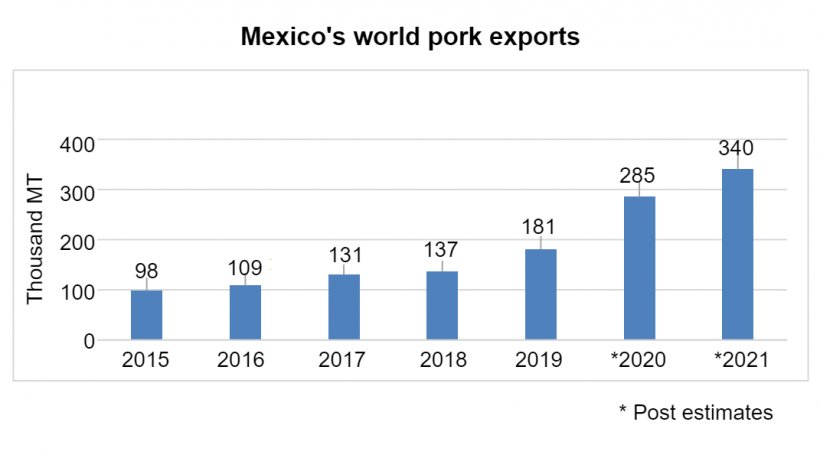

Mexico’s pork exports are expected to be 340,000 MT in 2021. This forecast is attributed to the increased international demand for Mexican pork as Mexican pork supply remains stable and the product retains its high quality. Mexico’s pork industry expects MY 2021 to see stabilized pork exports to the United States, retaining that market as the third main export destination for Mexican pork. Asian countries, such as China, Japan, and South Korea, have driven Mexico’s pork exports to new heights. Japan has increased its share of pork imports from Mexico at a rate of 19 percent in the first two quarters of 2020. Mexico’s pork industry expects this positive trend to continue throughout 2021.

July 31, 2020/ USDA/ United States.

https://apps.fas.usda.gov/